Technical Indicators and Technical Analysis

Technical Analysis is based on the belief that 'technical indicators'

give insight into the current and future market situation. A technical indicator

is a function that retrieves information from a time series

of prices or trade volumes, and converts them to an output that can be used as a

trade signal for buying or selling at the right moment. For instance,

the Simple Moving Average (SMA) indicator with

a Time Period 100 adds the last 100 prices and divides the sum

by 100, this way getting the average price of the last 100 bars. If the current

price rises above the average, some traders believe that prices will further rise,

and take this as a buy signal. It the price falls below the average, they believe

that prices will further fall and they must sell.

|

Price 1

|

|

Indicator

Function |

|

Buy/Sell

Signal |

|

Price 2

|

|

|

Price 3

|

|

|

...

|

|

Price 100

|

|

Indicators usually generate buy or sell signals when they reach a threshold,

cross each other, or cross the price curve. About 1000 different indicators are

published in books and trading magazines, from the very simple to the very bizarre.

The most often used are available in Zorro's indicators and time series library.

The library contains moving averages, oscillators, bands, momentum, strength indices,

divergence, support and resistance, linear and polynomial regression, signal processing,

and machine learning. It is divided in several sections:

- Indicators - common technical indicators, some new,

some old, some useful, listed below in alphabetical order.

- Candle Patterns - library of fixed candle patterns

used by Japanese rice traders in the 18th century.

- Series Analysis - functions for transforming time

series and retrieving statistical and other properties.

- Spectral Analysis - functions for analyzing or

filtering time series by their frequency components and cycles.

- Normalization - functions for scaling and compressing

time series, often needed for machine learning.

- slope, line - functions

for connecting points on the price curve.

- crossOver/Under,

rising/falling,

peak/valley - functions for detecting

events in a time series.

Aside from the indicators and time series functions, price curves and portfolio

performance can also be analyzed with other methods:

Most indicators use the TA-Lib indicator library by Mario Fortier (www.ta-lib.org)

and Zorros indicators.c library. Both are open source and included

in the Zorro\Source folder. The most usual indicator categories are marked:

Mkt = Market State, f.i. for detecting trend or cycle regime,

Avg = Averaging or lowpass filter for

curve smoothing,

Rng = Indicator based on price ratios or differences,

Osc = Oscillator, a measure usually in 0..100 range.

Indicators that do not fall under any above category are not marked.

If you need an indicator that is is missing, simply add it. Most technical indicators

are primitive and can be implemented in a few minutes with a few lines of code. How to implement an

indicator is described in Workshop4a and in the Petra on Programming series on

Financial Hacker.

The file indicators.c contains the source codes of many nonstandard

indicators, so you can use it as learning material for adding more complex indicators.

AC(vars Data): var

Osc

Accelerator Oscillator by Bill Williams; the difference of the AO

indicator (see below) and its 5-bar simple moving average (SMA).

Believed to indicate acceleration and deceleration of a 'market driving force' (whatever

that means). For Data normally a MedPrice

or price series is used. Source code in indicators.c.

ADO(): var

Osc

Accumulation/Distribution Oscillator: ((Close-Low)-(High-Close))/(High-Low).

Ranges from -1 when the close is the low of the bar, to

+1 when it's the high. Supposed to gauge supply and demand by determining

whether traders are generally "accumulating" (buying) or "distributing" (selling).

This indicator was published in many individual variants to the formula, but none

of them seems any better than the other. Uses the current asset price series. Source

code in indicators.c.

ADX(int TimePeriod): var

ADX(vars Open, vars High, vars Low, vars Close, int TimePeriod): var

Osc

Average Directional Movement Index. Moving average of the

DX indicator (see below). The first version uses the current asset price series and does

not support TimeFrame. The returned values range from 0 to 100.

ADXR(int TimePeriod): var

Osc

Average Directional Movement Index Rating. The average of the current ADX

and the ADX from TimePeriod bars ago. Uses the

current asset price series and does not support TimeFrame.

Alligator(vars Data): var

Avg

Alligator Indicator by Bill Willams. Consist of three lines: blue = SMA(13)

delayed by 5 bars; red: SMA(8) delayed by 2 bars; green:

SMA(5). Indicates a down trend with lines in the order blue-red-green

(top to bottom), and an uptrend with green-red-blue. The closer the Alligator’s

lines move, the weaker the trend gets and vice versa. Does not contain the additional

3 bars lag of the original Alligator algorithm (use Data+3 for

that). For Data normally the high/low average (MedPrice

series) is used. Result in rRed, rGreen,

rBlue. Source code in indicators.c.

ALMA(vars Data, int TimePeriod, int Sigma, var Offset): var

ALMA(vars Data, int TimePeriod): var

Arnaud Legoux Moving Average. Based on a Gaussian distribution with a bias towards

the begin of the Data series (i.e. more recent prices). Parameters:

Sigma (distribution width, default 6);

Offset (bias factor, default 0.85). Source code in

indicators.c.

AO(vars Data): var

Avg Awesome Oscillator by Bill Williams; simply the difference of a

5-bar and a 34-bar SMA. For Data normally a

MedPrice or price series is used.

Source code in indicators.c.

APO(vars Data, int FastPeriod, int SlowPeriod, int MAType): var

Osc

Absolute Price Oscillator; a more general version of the AO. Returns

the difference between two moving averages. Parameters: FastPeriod (Number

of period for the fast MA), SlowPeriod (Number of period for the slow MA),

MAType (Type of Moving Average).

Aroon(int TimePeriod): var

Osc

Aroon indicator. Consists of two lines (Up and Down) that measure how long it has

been since the highest high/lowest low has occurred within the time period. Uses

the current asset price series. Does not support TimeFrame. Result

in rAroonDown, rAroonUp.

AroonOsc(int TimePeriod): var

Osc

Aroon Oscillator. Calculated by subtracting the Aroon Down from the Aroon Up. The

return value will oscillate between +100 and -100. Uses the current asset price

series. Does not support TimeFrame.

ATR(int TimePeriod): var

Rng

Average True Range. A measure of price volatility; useful for calculating stop loss

or profit target distances. Formula: ATR = (ATR1 * (TimePeriod-1) + max(High,Close)-min(Low,Close))

/ TimePeriod, where ATR1 is the ATR from

the last bar. Uses the current asset prices. TimeFrame

must be zero or positive. The function internally creates series

when TimeFrame is > 1,

(see remarks). See also:

Volatility, CVolatilty,

TrueRange, ATRS.

ATR(vars Opens, vars Highs, vars Lows, vars Closes, int TimePeriod): var

Rng

Average True Range from arbitrary price series, with arbitrary offset and time frame.

Use this function when TimeFrame is

not constant, but changes from bar to bar, f.i. when skipping bars outside market

hours or aligning to the end of day.

ATRS(int TimePeriod): var

Rng

Simple Average True Range. SMA of the

TrueRange over the TimePeriod,

using the current asset price series. A measure of price volatility, simpler to

calculate than the ATR, but adapting slow to volatility changes

and thus less suited for stop loss / profit targets. Used by the

MTR4 platform instead of the real ATR. Does not support

TimeFrame. Source code in indicators.c.

AvgPrice(): var

Average Price. Simply (Open+High+Low+Close)/4 with the current asset price series.

BBands(vars Data, int TimePeriod, var NbDevUp, var NbDevDn, int MAType)

Bollinger Bands. Consist of three lines; the middle band is a moving average (usually

a 20 periods SMA) of the Data series. The upper

and lower bands are NbDevUp standard deviations above and

NbDevDn standard deviations below the middle band. The bands widen

and narrow when the volatility of the Data series is higher or

lower, respectively. They collapse to a line when the standard deviation is less

than 0.0001. Result in rRealUpperBand, rRealMiddleBand,

rRealLowerBand. Parameters: NbDevUp (Deviation multiplier for upper

band, usually 2), NbDevDn (Deviation multiplier for lower

band, usually 2), MAType (Type of Moving Average, usually

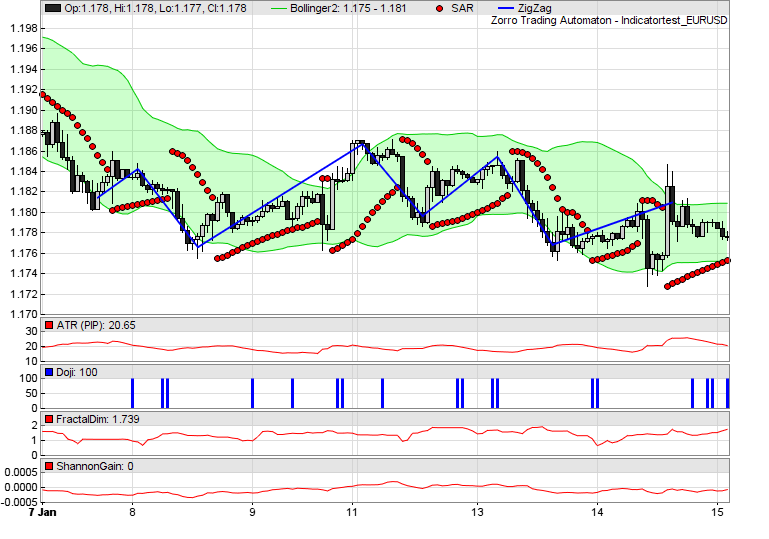

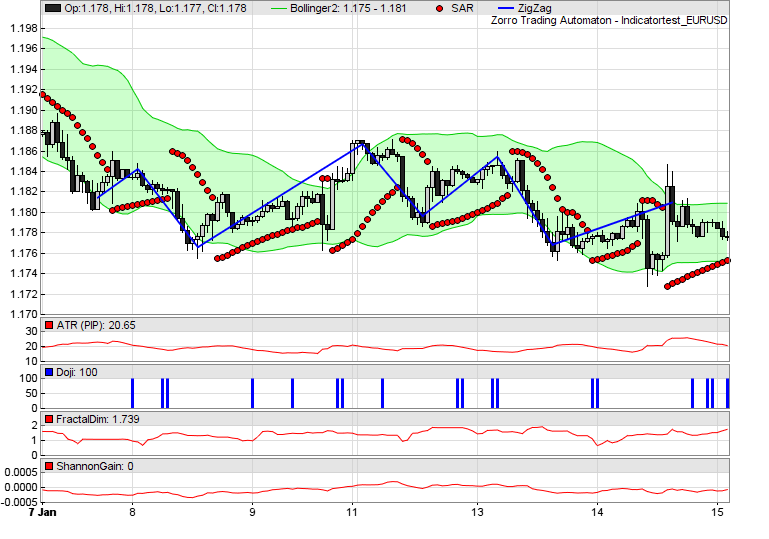

MAType_SMA). Example in Indicatortest.c.

BBOsc(vars Data, int TimePeriod, var NbDev, int MAType): var

Osc

Bollinger Bands Oscillator; the percentage of the current value of the series within

the Bollinger Bands.

Beta(vars Data, vars Data2, int TimePeriod): var

Beta value. A measure of a single asset's prices versus the overall market index.

The asset price is given in Data and the market index price (f.i.

S&P 500, DAX, etc) is given in Data2. The algorithm calculates

the change between prices in both series and then stores these changes as 2-dimensional

points. The x value of any point is the Data2 (market) change and

the y value is the Data (asset) change. The beta value is the slope

of a linear regression line through these points. A beta of 1 is simple the line

y=x, so the asset varies percisely with the market. A beta of less than one means

the asset varies less than the market and a beta of more than one means the asset

varies more than the market.

BOP(): var

Balance Of Power; simply (Close - Open)/(High - Low). Uses the current asset price

series.

CCI(int TimePeriod): var

Osc

Commodity Channel Index. Variation of the price from its statistical mean, typically

oscillates between +/-100. Formula: CCI = (TypPrice-SMA(TypPrice)) / (.015 x SMA(Numerator)). Uses the current asset price series. Does not support

TimeFrame.

CCYI(vars Data, int TimePeriod): var

Ehlers' Correlation Cycle Indicator. Measures the Spearman correlation of the Data series

with a sine wave. Source code in indicators.c. Details on

Financial Hacker.

CCYIR(vars Data, int TimePeriod): var

CCYI rate of change; the first derivative of the CCYI. Source code in indicators.c.

CCYIState(vars Data, int TimePeriod, var Threshold): var

Mkt

Market state based on the CCYI. Measures the phase angle difference between the Data series and a

correlated sine wave, and returns 1 for rising trend regime, -1 for falling trend regime, and 0 for cycle regime.

The critical angle difference in degrees is set with the Threshold parameter (0..45).

Source code in indicators.c. Details on

Financial Hacker.

CI(int TimePeriod): var

Osc

Choppiness Index; measures single bar price volatility in relation to the volatility

of the past TimePeriod in a 1..100 range. Uses the current asset

price series. Does not support TimeFrame.

ChandelierLong(int TimePeriod, var Multiplier): var

ChandelierShort(int TimePeriod, var Multiplier): var

Chandelier exit; the highest price of TimePeriod minus the

ATR multiplied with Multiplier. Normally

used as a trailing Stop Loss, for keeping trades in a trend

and preventing an early exit as long as the trend continues. Source code in

indicators.c. Does not support TimeFrame. Example

in the TMF chapter.

CGOsc(vars Data, int TimePeriod): var

Osc

Center of Gravity oscillator, by John Ehlers; computes the deviation of prices from

their center within the TimePeriod. Can be used to identify price

turning points with almost zero lag. Source code in indicators.c.

Chikou(int Shift): var

Chikou line belonging to the Ichimoku indicator; simply

a delayed Close moved forward by Shift. Uses the current asset

price series. Source code in indicators.c. The traditional Ichimoku

requires a future peeking Chikou line (Shift = -26); this can be

achieved by setting Shift = 0 and moving the rest of the Ichimoku

forward by Offset = 26.

CMO(vars Data, int TimePeriod): var

Osc

Chande Momentum Oscillator. Similar to the RSI,

but divides the total data movement by the net movement ((up - down) / (up + down)).

Coral(vars Data): var

Avg

Coral Indicator, simply a T3 with TimePeriod = 60

and VolumeFactor = 0.4. Source code in indicators.c.

ConnorsRSI(vars Data, int RSIPeriod, int StreakPeriod, int RankPeriod): var

Osc

Indicator by Larry Connors, mean of a 3 period RSI

on Data, a 2 period RSI of the recent up/down streak, and the

percent rank of the recent change. Fluctuates

between 0 and 100 and believed to indicate the overbought (high values) or oversold

(low values) level. The function internally creates series

(see remarks). Source code in indicators.c.

CTI(vars Data, int TimePeriod): var

Ehlers' Correlation Trend Indicator. Measures the Spearman correlation of the Data series

with a rising trend. Source code in indicators.c.

DChannel(int TimePeriod)

Donchian Channel; the minimum and maximum value of the

priceHigh and

priceLow functions over the time period.

Basis of the famous Turtle Trading System. Uses the current asset

price series. Does not support TimeFrame. Result in rRealUpperBand,

rRealLowerBand.

DCOsc(vars Data, int TimePeriod): var

Osc

Donchian Channel Oscillator; the percentage of the current Data

value within the Donchian Channel. Uses the current asset and current

TimeFrame.

Decycle(vars Data, int CutOffPeriod): var

Ehlers' Decycler, a low-lag trend indicator; simply Data -

HighPass2(Data,CutOffPeriod). Removes all cycles

below CutOffPeriod from the Data series and keeps

the trend. The function internally creates series (see remarks). Source code in indicators.c.

DEMA(vars Data, int TimePeriod): var

Avg

Double Exponential Moving Average.

Divergence(vars Highs, vars Lows, vars Data, int TimePeriod): int

Mkt

Regular or hidden divergence. Draws lines through the two most prominent peaks and

valleys of the Highs and Lows series, and compares with lines through the

two most prominent valleys and peaks of the Data series within

the TimePeriod. Highs and Lows are usually from a price curve, while

Data is

from an oscillating indicator,

such as MACD, CCI, RSI,

Stoch, etc. Some traders believe that

a divergence between the lines predicts a trend change. Bullish regular divergence

means that the price makes lower lows, while the oscillator does not. Bearish

regular divergence means that the price makes higher highs, while the oscillator

does not. Bullish hidden divergence means that the oscillator makes

higher highs, while the price does not. Bearish hidden divergence

means that the oscillator makes lower lows, while the price does not. The function

returns:

0 - No divergence

1 - Bullish regular

divergence

2 - Bearish regular divergence

4

- Bullish hidden divergence

8 - Bearish hidden divergence.

The returned value can be a combination, f.i. 5 = 1+4

= bullish regular + bullish hidden divergence. All combinations are possible.

The slope of the determining line (movement per bar)

is stored in rSlope. Source code in indicators.c.

DPO(vars Data, int TimePeriod): var

Osc

Detrended Price Oscillator; believed to detect early changes in price direction.

DPO = Data[0] - SMA(Data[n/2+1],n), where n is

the TimePeriod. Source code in indicators.c.

DX(int TimePeriod): var

DX(vars Open, vars High, vars Low, vars Close, int TimePeriod): var

Osc Directional Movement Index by Welles Wilder,

who discovered

that "the interaction of sun, moon, and earth is the basis of all market movement".

In case that celestial bodies refrain from moving the market,

he also invented the DX, which he believed to indicate trend strength. The values

range from 0 to 100, but rarely get above 60. The first DX

version uses the current

asset price series and does not support TimeFrame. Formula:

DX = 100 * abs(PlusDI-MinusDI) / (PlusDI+MinusDI). For

PlusDI and MinusDI

see the description below.

EMA(vars Data, int TimePeriod): var

Avg

Exponential Moving Average. Emphasizes more recent data values. It uses the formula

EMA = alpha * data + (1-alpha) * EMA1, where alpha

is 2.0/(TimePeriod+1), and EMA1 is the previous

EMA value. The higher the time period, the smaller is alpha and the higher is the smoothing effect

of the EMA formula. The function requires a Data length of TimePeriod+UnstablePeriod+1.

EMA(var Input, int TimePeriod): var

EMA(var Input, var alpha): var

Avg

Exponential Moving Average as above, alternative version that uses a single variable as input

and also accepts the alpha parameter (see above). Does not use UnstablePeriod,

but creates an internal series.

ER(vars Data, int TimePeriod): var

Osc

Kaufman's Efficiency Ratio, the amount of price changes in the given interval in

relation to the absolute price change. Source code in indicators.c.

FractalHigh(vars Data, int TimePeriod): var

Fractal High, an indicator by Bill Williams, believed to signal when the market

reverses (has nothing to do with fractals). Returns the highest Data

value when it is in the center of the TimePeriod, otherwise

0.

FractalLow(vars Data, int TimePeriod): var

Fractal Low. Returns the lowest Data value when it is in the center

of the TimePeriod, otherwise 0.

HAOpen(): var

HAClose(): var

HAHigh(): var

HALow(): var

Haiken Ashi prices of the current bar, based on the current asset prices. Except for

HAClose, the functions internally create series (see remarks). Source code in indicators.c.

HH(int TimePeriod, int Offset): var

Highest value of the priceHigh function

over the TimePeriod ending with Offset (default

0). F.i. HH(3,1) returns the highest price of

the 3 bars before the current bar. Uses the current asset price series. Sets

rMaxIdx to the bar offset with the highest price.

TimeFrame > 1 is supported. Source code in indicators.c.

See also dayHigh.

HMA(vars Data, int TimePeriod): var

Avg

Hull Moving Average by Alan Hull; attempts to address lag as well as to smooth out

some choppiness. Formula:HMA(n) = WMA(2*WMA(n/2) – WMA(n)),sqrt(n)).

The function internally creates a series (see remarks). Source code in indicators.c.

HTDcPeriod(vars Data): var

Osc

Hilbert Transform - Dominant Cycle Period, developed by John Ehlers. Hilbert transform

algorithms are explained in Ehler's book "Rocket Science for Traders"

(see book list). This function is equivalent, but less accurate

than the DominantPeriod function.

HTDcPhase(vars Data): var

Osc

Hilbert Transform - Dominant Cycle Phase.HTPhasor(vars Data): var

Hilbert Transform - Phasor Components. Result in rInPhase, rQuadrature.

HTSine(vars Data): var

Osc

Hilbert Transform - SineWave. Result in rSine, rLeadSine.HTTrendline(vars

Data): var

Avg

Hilbert Transform - Instantaneous Trendline.HTTrendMode(vars Data): int

Mkt

Hilbert Transform trend indicator - returns 1 for Trend Mode,

0 for Cycle Mode.

IBS(): var

Osc

Internal Bar Strength; relative position in percent of the close price with respect

to the low to high range for the same period. Source code in indicators.c.

Ichimoku()

Ichimoku(int PeriodTenkan, int PeriodKijun, int PeriodSenkou, int Offset)

Avg

Ichimoku Kinko Hyo indicator. Invented by the journalist Goichi Hosoda in the 1930s,

and today again in fashion due to its enormous number of colorful lines. The Ichimoku

is a mix of the medium prices of 3 time periods. Offset (default

0) determines the bar for calculating the indicator, and can be used to shift all

lines forward. The function returns 4 variables:

rTenkan = (HH+LL)/2

with PeriodTenkan (default 9)

rKijun

= (HH+LL)/2 with PeriodKijun (default 26)

rSenkouA = (rTenkan+rKijun)/2, shifted forward by PeriodKijun.

Forms a "cloud band" with rSenkouB.

rSenkouB

= (HH+LL)/2 with PeriodSenkou (default 52),

shifted forward by PeriodKijun

Another line belonging to

the Ichimoku, the Chikou line, is future

peeking and calculated separately. The function uses the current asset price series.

It internally creates series when

TimeFrame is > 1

(see remarks). Source code in indicators.c.

KAMA(vars Data, int TimePeriod): var

Avg

Kaufman Adaptive Moving Average. An exponential moving average adjusted by price

volatility, so its time period becomes shorter when volatility is high.

KAMA2(vars Data, int ERPeriod, int FastPeriod, int SlowPeriod): var

Avg

Kaufman Adaptive Moving Average as above, but the volatilty detection period as

well as the short and long time period can be set separately. Internally creates

series (see remarks).

Source code in indicators.c.

Keltner(vars Data, int TimePeriod, var Factor): var

Avg

Keltner Channel, by Charles Keltner. A Simple Moving Average - SMA(Data,TimePeriod)

- with side bands in the distance Factor * ATRS(TimePeriod). Results

in rRealUpperBand, rRealMiddleBand, rRealLowerBand. Source

code in indicators.c.

LL(int TimePeriod, int Offset): var

Lowest value of the priceLow function over

the TimePeriod ending with Offset (default

0). F.i. LL(3,10) returns the lowest price between

the last 10 and the last 13 bars. Uses the current asset price series. Sets

rMinIdx to the bar offset with the lowest price.

TimeFrame > 1 is supported. Source code in indicators.c.

See also dayLow.

LSMA(vars Data, int TimePeriod, int Offset): var

Avg

Least Squares Moving Average. Calculates a linear regression line over the recent

TimePeriod, and returns the value of that line at the given bar

Offset (0 for the current bar). Negative offsets

return future values of the regression line and can be used for forecasting. See

also QLSMA, polyfit,

LinearReg, predict. Source

code in indicators.c.

MACD(vars Data, int FastPeriod, int SlowPeriod, int SignalPeriod)

Rng

Moving Average Convergence/Divergence. The MACD is an intermediate-term

trend indicator, created by subtracting a 26-period Exponential Moving Average (EMA,

see above) from a 12-period EMA. A nine-period EMA

is then applied to the MACD result to create a 'signal line'. A

MACD Histogram line is finally created from the difference of the

MACD to its signal line. It is believed that the zero crossing

of the histogram from below is a buy signal, zero crossing from above a sell signal.

The formula is:

rMACD = EMA(Data,FastPeriod)-EMA(Data,SlowPeriod);

rMACDSignal = EMA(rMACD,SignalPeriod);

rMACDHist = rMACD - rMACDSignal;

Results in rMACD, rMACDSignal, rMACDHist. Returns: rMACD.

Parameters: FastPeriod (time period for the fast MA), SlowPeriod (time

period for the slow MA), SignalPeriod (time period for smoothing the signal

line).

MACDExt(vars Data, int FastPeriod, int FastMAType, int SlowPeriod, int SlowMAType,

int SignalPeriod, int SignalMAType)

Rng

MACD with controllable MA type. Result in rMACD, rMACDSignal, rMACDHist.

Parameters: FastPeriod (time period for the fast MA), FastMAType (Type

of Moving Average for fast MA), SlowPeriod (time period for the slow MA),

SlowMAType (Type of Moving Average for slow MA), SignalPeriod (time

period for smoothing the signal line), SignalMAType (Type of Moving Average

for signal line).

MACDFix(vars Data, int SignalPeriod)

Rng

Moving Average Convergence/Divergence Fix 12/26. Result in rMACD, rMACDSignal,

rMACDHist. Parameters: SignalPeriod (time period for smoothing the

signal line).

MAMA(vars Data, var FastLimit, var SlowLimit)

Avg

MESA Adaptive Moving Average, developed by John Ehlers (see

links). Result in rMAMA, rFAMA. Parameters: FastLimit (Upper

limit use in the adaptive algorithm), SlowLimit (Lower limit use in the adaptive

algorithm).

MedPrice(): var

Center price; simply the center point (High+Low)/2

of the current candle. For the mean price - the average of all price ticks of the

candle - use price(). For the middle price between Ask and

Bid, take the ask price and add Spread/2.

MidPoint(vars Data, int TimePeriod): var

MidPoint over period. Simply (highest value + lowest value)/2.

MidPrice(int TimePeriod): var

Midpoint price over period. Simply (highest high + lowest low)/2 of the current

asset price series. Does not support TimeFrame.

MinusDI(int TimePeriod): var

MinusDI(vars Open, vars High, vars Low, vars Close, int TimePeriod): var

Osc Minus Directional Indicator, part of the

DX indicator, ratio of a smoothed MinusDM

to ATR in percent. If the function is not called with different

price series, the current asset price series is used.

MinusDM(int TimePeriod): var

MinusDM(vars Open, vars High, vars Low, vars Close, int TimePeriod): var

Rng Minus Directional Movement, the difference of

current low and previous low. In the first version the current asset price series is used.

MMI(vars Data, int TimePeriod): var

Mkt

Market Meanness Index by

Financial Hacker. Measures the mean reversal tendency of the market in a 0..100% range. Random numbers have a MMI of 75%.

Real prices are more or less autocorrelated, so the probability of a real price

series to revert to the mean is less than 75%, but normally more than 50%. The higher

it is, the 'meaner' the market behaves towards trend following systems. The Market Meanness

Index can determine when trend following systems will become more profitable (MMI

is falling) or less profitable (MMI is rising), and thus prevent losses in unprofitable

periods. Source code in indicators.c.

Mom(vars Data, int TimePeriod): var

Rng

Momentum. Simply Data[0] - Data[TimePeriod]. See also

RET and

diff.

MovingAverage(vars Data, int TimePeriod, int MAType): var

Avg

Moving average. Parameters: MAType (Type of Moving Average, see remarks).

MovingAverageVariablePeriod(vars Data, vars Periods, int MinPeriod, int MaxPeriod,

int MAType): var

Avg

Moving average with variable period given by the Periods series.

Parameters: MinPeriod (Value less than minimum will be changed to Minimum

period), MaxPeriod (Value higher than maximum will be changed to Maximum

period), MAType (Type of Moving Average, see remarks).

NATR (int TimePeriod): var

Osc

Normalized Average True Range, by John Forman. Similar to the ATR, except it is

being normalized as follows: NATR = 100 * ATR(TimePeriod) / Close.

Uses the current asset price series. Does not support TimeFrame.

NumWhiteBlack (var Body, int Offset, int TimePeriod): var

Number of white minus number of black candles in the given TimePeriod.

Offset is the distance to the current bar (0 =

current bar), Body is the minimum length of a candle to be counted.

Source code in indicators.c.

OBV (vars Data, var Volume): var

On Balance Volume, by Joseph Granville. The cumulative difference of the up and

down volume. Data is normally a Close series, Volume

can be taken from marketVol. Because it is cumulative, its

absolute value depends on the start date and previous history. Source code in

indicators.c.

Pivot (int TimePeriod, int Offset)

The 'pivot point' (High+Low+Close)/3 of the given TimePeriod

at the given bar Offset. Uses the current asset time series, but

TimeFrame is supported. See also dayPivot.

Source code in indicators.c.

PlusDI (int TimePeriod): var

PlusDI (vars Open, vars High, vars Low, vars Close, int TimePeriod): var

Osc Plus Directional Indicator, a part of the

DX indicator, ratio of a smoothed PlusDM

to ATR in percent. In the first version the current

asset price series is used.

PlusDM (int TimePeriod): var

PlusDM (vars Open, vars High, vars Low, vars Close, int TimePeriod): var

Rng

Plus Directional Movement, the difference of current high and previous high. In the first version the current asset

price series is used.

PPO(vars Data, int FastPeriod, int SlowPeriod, int MAType): var

Osc

Percentage Price Oscillator, the normalized difference of two averages. Parameters: FastPeriod (Number of period for

the fast MA), SlowPeriod (Number of period for the slow MA), MAType

(Type of Moving Average).

ProfitFactor(vars Data, int Length): var

Returns the profit factor of the Data series. The profit factor

is the ratio of the sum of positive returns (i.e. Data[i-1] > Data[i])

to the sum of negative returns (Data[i-1] < Data[i]). The returned

value is clipped to the 0.1...10 range. Use its reciprocal when

the Data array is in not in series order,

but in ascending order, as wins and losses are then swapped. Source available in

indicators.c.

QLSMA(vars Data, int TimePeriod, int Offset): var

Avg

Quadratic Least Squares Moving Average. Calculates a parabolic regression curve

over the recent TimePeriod, and returns the value of that curve

at the given bar Offset (0 for the current bar).

Negative offsets return future values of the regression curve and can be used for

forecasting. See also LSMA, polyfit,

LinearReg, predict. Source

code in indicators.c.

Resistance(vars Data, int TimePeriod): var

Resistance line; returns the average of the two highest Data peaks

in the TimePeriod, or 0 when no peaks are found.

The slope (Data difference per bar) of the line through the two

peaks is stored in rSlope and can be used to determine if the resistance

line is flat enough. See also Support, Divergence,

pivot levels. Source code in indicators.c.

RET(int TimePeriod): var

Rng

Return of the current asset: (Close(0)-Close(TimePeriod))/Close(TimePeriod).

Source code in indicators.c

ROC(vars Data, int TimePeriod): var

Rng

Rate of change, 100 scale: ((price-prevPrice)/prevPrice)*100.

ROCP(vars Data, int TimePeriod): var

Rng

Rate of change: (price-prevPrice)/prevPrice. See also

diff.

ROCR(vars Data, int TimePeriod): var

Rng

Rate of change ratio: (price/prevPrice).

ROCR100(vars Data, int TimePeriod): var

Rng

Rate of change ratio, 100 scale: (price/prevPrice)*100.

ROCL(vars Data, int TimePeriod): var

Rng

Logarithmic return: log(price/prevPrice).

Roof(vars Data, int CutoffLow, int CutoffHigh): var

Avg

Ehlers' roofing filter, prepares the Data series for further computation

by removing trend and noise. Applies a 2-pole highpass filter followed by the

Smooth filter. Recommended values for the low and high cutoff periods

are 10 and 50. The minimum length of the

Data series is 2. The function internally creates

series (see remarks). Source available in indicators.c.

RSI(vars Data, int TimePeriod): var

Osc Relative Strength Index, by Welles Wilder. Ratio of the recent

upwards data movement to the total data movement; range 0..100. The RSI is believed

to indicate overbought/oversold conditions when the value is over 70/below 30. Formula:

RSI = 100 * Up/(Up+Dn), where Up = EMA(max(0,Data[0]-Data[1]),TimePeriod)

and Dn = EMA(max(0,Data[1]-Data[0]),TimePeriod).

RSIS(vars Data, int TimePeriod): var

Osc Relative Strength Index variant, using the simple average of

the Up/Dn sums instead of an EMA. This RSI variant is used by several trading platforms

instead of the original version.

RVI(int TimePeriod): var

Osc

Relative Vigor Index, by John Ehlers. Ratio of price change to the total price range:

(C-O)/(H-L), averaged over the time period and smoothed with a

FIR filter. Oscillates between -1 and 1. The function

internally creates a series (see remarks). Source code in indicators.c.

SAR(var Step, var Min, var Max): var

Parabolic SAR by Welles Wilder. The SAR runs above or below the price curve, depending

on the current trend; each price curve crossing is believed to indicate a trend

change. Parameters: Step (acceleration factor increment, normally

0.02), Min (acceleration factor minimum value, normally

0.02), Max (acceleration factor maximum value, normally

0.2). SAR is a recursive function that depends on the

direction of the initial price candle; for consistent values the

LookBack period should be long enough to contain at least

one price curve crossing. Uses the current asset prices. The function internally

creates a series (see remarks). Source code in indicators.c, example in

Indicatortest.c.

SentimentLW(int TimePeriod): var

Osc

Market Sentiment Index by Larry Williams, based on the averaged differences of day

closes to day highs/lows. Returns a 0..100 percentage. Williams believed that a

high index indicates a bullish market saturation and predicts sells, while a low

index indicates no bullishness and predicts buys. Uses the current asset prices.

The function internally creates a series (see remarks). Source code in indicators.c.

SentimentG(int TimePeriod): var

Osc

Genesis Sentiment Index, the current price in relation to the given TimePeriod,

usually 6 months. Returns a 0..100 percentage; believed to indicate a bullish market

with a high index and bearishness with a low index. Uses the current asset prices.

The function internally creates a series (see remarks). Source code in indicators.c.

Sharpe(vars Data, int TimePeriod): var

Sharpe ratio; the mean of the Data series divided by its standard

deviation. Source code in indicators.c.

SIROC(vars Data, int TimePeriod, int EMAPeriod): var

Rng

Smoothed Rate of Change (S-RoC) by Fred G Schutzman. Differs from the ROC

(see above) in that it is based on the exponential moving average (EMA)

of the Data series. Believed to indicate the strength of a trend

by determining if the trend is accelerating or decelerating. Formula: (Current EMA

- Previous EMA)/(Previous EMA) x 100. Source code in indicators.c.

SMA(vars Data, int TimePeriod): var

Avg Simple Moving Average; the mean of the Data

series, i.e. the sum of all elementes divided

by the time period. Use Moment when long

time periods are required.

SMAP(vars Data, int TimePeriod): var

Avg

Mean of Data as above, but counting only nonzero positive values.

Can be used to skip inactive periods f.i. for calculating the average volume. Source

code in indicators.c.

Smooth(vars Data, int CutoffPeriod): var

Avg

Ehlers' 'Super Smoother' filter, a 2-pole Butterworth filter combined with a

SMA that suppresses the Nyquist frequency.

Can be used as a low-lag universal filter for removing noise from price data. The

minimum length of the Data series is 2. The function internally

creates series (see remarks). Source available in indicators.c.SMom(vars Data,

int TimePeriod, int CutoffPeriod): var

Rng

Smoothed Momentum by John Ehlers; indicates the long term trend direction.

TimePeriod is the momentum period, CutoffPeriod

is a Butterworth filter constant for lowpass filtering the momentum. Source code

in indicators.c.

Sortino(vars Data, int TimePeriod): var

Sortino ratio; the mean of the Data series divided by its semi-deviation,

i.e. by the standard deviation of Data values below the mean. Source

code in indicators.c.

Stoch(int FastK_Period, int SlowK_Period, int SlowK_MAType, int SlowD_Period,

int SlowD_MAType)

Stoch(vars Open, vars High, vars Low, vars Close, int FastK_Period, int SlowK_Period,

int SlowK_MAType, int SlowD_Period, int SlowD_MAType)

Osc Stochastic Oscillator (not related to

stochastic, but its inventor,

George Lane, looked for an impressive name). Measures where the Close price is in relation

to the recent trading range. Formula: FastK = 100 * (Close-LL)/(HH-LL);

SlowK = MA(FastK); SlowD = MA(SlowK). Some traders

believe that the SlowK crossing above SlowD is

a buy signal; others believe they should buy when SlowD is below

20 and sell when it is above 80. Two versions; the first version uses the current

asset price series and does not support TimeFrame. Result in

rSlowK, rSlowD. Returns SlowD. Parameters:

FastK_Period - Time period for

the HH and LL to generate the FastK

value, usually 14.

SlowK_Period - Time period for smoothing

FastK to generate rSlowK; usually 3.

SlowK_MAType - Type of Moving Average for Slow-K, usually MAType_SMA.

SlowD_Period - Time period for smoothing rSlowK to generate rSlowD,

usually 3.

SlowD_MAType - Type of Moving Average for

Slow-D, usually MAType_SMA.

StochEhlers(vars Data, int TimePeriod, int CutOffLow, int CutOffHigh): var

Osc

Predictive stochastic oscillator by John Ehlers. Measures where the Data

value is in relation to its range within TimePeriod. The data runs

through a 2-pole highpass filter with period CutOffHigh and through

a Butterworth lowpass filter with period CutOffLow. Indicator algorithm

explained in Ehler's "Predictive Indicators" paper; usage example in the

Ehlers script. Source code in indicators.c.

The function internally creates series (see remarks).

StochF(int FastK_Period, int FastD_Period, int FastD_MAType): var

Osc

Stochastic Fast; Stoch without the SlowK part. Measures where the Close price is in relation to the recent trading

range; Formula: Fast-K = 100 * (Close-LL)/(HH-LL); Fast-D

= MA(Fast-K). Uses the current asset price series, and does not support

TimeFrame. Results in rFastK, rFastD. Returns

FastD. Parameters:

FastK_Period (Time period for the

HH and LL of Fast-K, usually 14),

FastD_Period (Moving Average Period for Fast-D; usually 3),

FastD_MAType (Type of Moving Average for Fast-D, usually MAType_SMA).

StochRSI(vars Data, int TimePeriod, int FastK_Period, int FastD_Period, int

FastD_MAType): var

Osc

Stochastic Relative Strength Index. The fast Stoch applied to

the RSI in hope to get an even better result. Results in rFastK,

rFastD. Returns FastD. Parameters:

TimePeriod

- for the RSI, usually 14,

FastK_Period - Time period for building the Fast-K line,

usually 14,

FastD_Period - Smoothing for

making the Fast-D line, usually 3,

FastD_MAType - Type of Moving

Average for Fast-D,usually MAType_SMA).

Support(vars Data, int TimePeriod): var

Support line; returns the average of the two lowest Data valleys

in the TimePeriod, or 0 when no valleys are found.

The slope (Data change per bar) of the line through the two

valleys is stored in rSlope and can be used to determine if the

support line is flat enough. See also Resistance, Divergence,

pivot levels. Source code in indicators.c.

T3(vars Data, int TimePeriod, var VFactor): var

Avg An extremely smoothed Moving Average by Tim Tillson. Uses

a weighted sum of multiple EMAs. Parameters: VFactor (Volume Factor, normally

0.7).

TEMA(vars Data, int TimePeriod): var

Avg

Triple Exponential Moving Average by Patrick Mulloy, calculated from (3xEMA)-(3xEMA

of EMA)+(EMA of EMA of EMA).

Trima(vars Data, int TimePeriod): var

Avg

Triangular Moving Average (also known under the name TMA); a form

of Weighted Moving Average where the weights are assigned in a triangular pattern.

F.i. the weights for a 7 period Triangular Moving Average would be 1, 2, 3, 4, 3,

2, 1. This gives more weight to the middle of the time series. It causes better

smoothing, but greater lag.

Trix(vars Data, int TimePeriod): var

1-day Rate-Of-Change (see ROC) of a Triple EMA (see TEMA).

TrueRange(): var

Rng True Range (TR); max(High[0],Close[1])-min(Low[0],Close[1])

of the current asset price series. See also ATR, ATRS.

TSI(vars Data, int TimePeriod): var

Mkt

Trend Strength Index, an indicator by Frank Hassler who believed that it identifies

trend strength. A high TSI value (above ~ 1.65) indicates that

short-term trend continuation is more likely than short-term trend reversal. The

function internally creates series (see remarks).

TypPrice(): var

Typical Price. Simply (High + Low + Close)/3. Uses the current

asset price series.

UltOsc(int TimePeriod1, int TimePeriod2, int TimePeriod3): var

Osc

Ultimate Oscillator. Parameters: TimePeriod1 (Number of bars for 1st period.),

TimePeriod2 (Number of bars for 2nd period), TimePeriod3 (Number of

bars for 3rd period). Uses the current asset price series. Does not support

TimeFrame.

UO(vars Data, int CutOff): var

Osc

Universal oscillator by John Ehlers, from S&C Magazine 1/2015. Removes white

noise from the data, smoothes it and runs it through the AGC

filter. Detects trend reversals very early. Output in the -1..+1 range. Source code

in indicators.c. The function internally creates

series (see remarks).

Volatility(vars Data, int TimePeriod): var

Annualized volatility of the Data series; standard deviation of

the logarithmic returns, multiplied with the square root of time frames in a year.

Data must be a series of positive values, normally a price

series. This is the standard measure of volatility used in financial models, such as the

Black-Scholes model.

For irregular Data series, corrections can be required to annualize the volatilty for all

time frames. If Data contains flat out-of-market periods, multiply the result with

the square root of trading bars per day divided by bar periods per day (example:

with 60 minute bars and 8 trading bars per day, multiply with sqrt(8./24)

= 0.58). If Data has a variable number

of bars per element by time frame synchronizing (frameSync),

divide the result by the square root of the average bars per time frame.

The function internally creates series

(see remarks). Source code in indicators.c.

A practical alternative for options calculations is VolatilityOV.

VolatilityC(int TimePeriod, int EMAPeriod): var

Rng

Chaikin Volatility indicator by

Marc Chaikin; measures volatility in percent as momentum of the smoothed

difference between High and Low. An increase in the Chaikin Volatility indicates

that a bottom is approaching, a decrease indicates that a top is approaching.

TimePeriod is the period of the momentum (normally 10),

EMAPeriod determines the smoothing (also, normally 10). Uses the current

asset price series. The function internally creates series

(see remarks). Source code in indicators.c.

VolatilityMM(vars Data, int TimePeriod, int EMAPeriod): var

Rng

Min/Max volatility of the Data series; the difference of

MaxVal and MinVal in the time period, smoothed

by an EMA (set EMAPeriod = 0 for no smoothing). The function internally

creates a series when EMAPeriod > 0

(see remarks). Source available in

indicators.c. For the volatility of price candles, use

ATR or ATRS.

VolatilityOV(int Days): var

Annualized volatility of the current asset, calculated over the given number of

Days (usually 20) regardless of the bar period. Empirical formula

used by options software packages (OptionVue™)

for estimating the values of options, alternatively to Volatility().

Source code in contract.c, which must be included for using this

indicator.

VolatilityP(int Days): var

Parkinson volatility of the current asset, calculated over the given number of

Days (usually 10) regardless of the bar period. The Parkinson

Volatility is the normalized square root of the natural logarithm of the ratio

of the daily high to low.

Source code in indicators.c.

VWAV(vars Data, vars Weights, int TimePeriod): var

Avg

Volume Weighted Average Value, the scalar product of Data and 1-normalized

Weights with length TimePeriod. Can be used to

calculate a volume averaged price (VWAP) by setting Data to a price

series and Weights to a corresponding volume series, f.i.

vars Prices = series(priceClose()); vars Volumes = series(marketVol());

var VWAP = VWAV(Prices,Volumes,Period); (Zorro S required). Source code

in indicators.c.

WCLPrice(): var

Weighted Close Price, the average of High, Low, and twice the Close. Uses the current

asset price series.

WillR(int TimePeriod): var

Rng

Williams' Percent Range. Formula: -100* (HH-Close)/(HH-LL). Uses

the current asset price series. Does not support TimeFrame.

WMA(vars Data, int TimePeriod): var

Avg

Linear Weighted Moving Average; the weight of every bar decreases linearly with

its age.

ZigZag(vars Data, var Depth, int Length, int Color): var

ZigZag indicator; converts the Data series into alternating straight

'legs' with at least the given Depth (in Data units) and Length (in bar units).

For not missing legs, the Depth threshold should be sufficient

low. ZigZag is non-predictive

and can only identify trends in hindsight. Returned: rSlope (the

slope of the last identified leg; upwards legs have a positive slope, downwards

legs a negative slope); rPeak (the bar offset of the last

identified peak); rLength

(the number of bars of the last zig or zag that ends with rPeak).

If a nonzero Color is given, the zigzag lines are plotted in the

chart. Source code in indicators.c, example in Indicatortest.c.

The function internally creates series (see remarks).

ZMA(vars Data, int TimePeriod): var

Avg

Zero-lag Moving Average by John Ehlers; smoothes the Data series

with an Exponential Moving Average (EMA) and applies an error

correction term for compensating the lag. The function internally creates a

series (see remarks). Source in indicators.c.

Standard parameters:

| TimePeriod |

The number of bars for the time period of the function,

if any; or 0 for using a default period. |

| MAType |

The type of the moving average used by the function:

MAType_SMA (default), MAType_EMA,

MAType_WMA, MAType_DEMA, MAType_TEMA,

MAType_TRIMA, MAType_KAMA, MAType_MAMA,

MAType_T3. |

| Data |

A data series in descending order (newest data

first), normally derived from the price functions

price(), priceC() etc. Alternatively

a user created series or any other double float array with the given minimum

length. If not mentioned otherwise, the minimum length of the Data

series is normally TimePeriod (see remarks). Some functions require a second data

series Data2. |

Open, High,

Low, Close |

Price data series can be explicitly given for

some indicators, for using price series generated from a different asset

or with a different TimeFrame. Otherwise the

prices of the current asset with a time frame equivalent to the bar period

are used. |

Returns:

Price variation or percentage, dependent on the function, for the current bar.

Usage example:

MACD(Price,12,26,9) calculates the standard MACD for the given

Price series. The results are stored in the global variables

rMACD, rMACDSignal, and rMACDHistory.

Remarks:

- The TA-Lib function prototypes are defined in include\functions.h.

The C++ source code of all included TA-Lib indicators is available in Source\ta_lib.zip. Some TA-Lib indicators that

originally didn't work properly - such as Correlation or SAR - have been replaced

by working versions. The C source code of most additional indicators that

are not part the the TA-Lib is contained in Source\indicators.c.

- TA-Lib indicators can only be used between INITRUN

and EXITRUN, since TA-Lib and series management are released at end of the

session. This restriction does not apply when the

STRAIGHT flag is set.

- All indicators are normally applied either on data series,

or on the price curve of the current asset. In the INITRUN,

indicators

return 0 and LookBack is

automatically

increased to the largest required lookback time by any used

indicator. Data series must

cover at least the indicator's lookback period, which is not always

identical to the given TimePeriod. If the required lookback

period by any indicator exceeds LookBack after

the INITRUN, an Error 046 message

will be issued. Make sure that

LookBack is always higher than the maximum

TimePeriod plus the UnstablePeriod of all

indicators plus the

highest offset of all used series.

- Some TA functions internally create data series, and thus

must be called the same number of times and in the same order at any bar.

They must therefore not depend on if conditions.

- Recursive indicators - f.i. EMA or

ATR - use a preceding value of itself as an input. Their results

thus depend on their previous history. Recursive functions from the TA-Lib

run over the whole UnstablePeriod at any call. This ensures

reproducible results regardless of the number of preceding bars, but requires a longer lookback period and increases the

backtest time. Recursive functions that are not from the TA-Lib (f.i.

LowPass)

do not use this mechanism, but store their values from preceding calls in an

internal series instead.

- Some indicators return more than one value, f.i. MACD. The

returned results are stored in global variables beginning with "r";

they can be accessed after the function is called.

- TimeFrame affects subsequent data

series and thus also affects all indicators that use

these data series as input. The TimePeriod is then not in Bar

units, but in time frame units. TimeFrame has no effect on

indicators that do not use data series. The required lookback period of an

indicator multiplies with the TimeFrame of its series.

- The MAType can be any of MAType_SMA,

MAType_EMA, MAType_WMA, MAType_DEMA, MAType_TEMA, MAType_TRIMA, MAType_KAMA, MAType_MAMA, MAType_T3.

- Indicators that rely on the standard deviation (f.i. Bollinger Bands) become

inaccurate when the standard deviation is below 0.0001, as it is then assumed

to be zero by the TA-Lib. This can happen on very short bar periods when the

price does (almost) not move.

- For writing your own indicators, have a look

at workshop 4a and at the examples inside

indicators.c. But please do not modify indicators.c

- write the indicators in your own script, or in a dedicated script that you

can then include in your strategies. If you need a

complex indicator that you can not be easily add, please ask for it on the Zorro

user forum.

Examples:

// plot some indicators

function run()

{

set(PLOTNOW);

var* Price = series(price());

// plot Bollinger bands

BBands(Price,30,2,2,MAType_SMA);

plot("Bollinger1",rRealUpperBand,BAND1,0x00CC00);

plot("Bollinger2",rRealLowerBand,BAND2,0xCC00FF00);

plot("SAR",SAR(0.02,0.02,0.2),DOT,RED);

ZigZag(Price,1*PIP,5,BLUE);

// plot some other indicators

plot("ATR (PIP)",ATR(20)/PIP,NEW,RED);

plot("Doji",CDLDoji(),NEW+BARS,BLUE);

plot("FractalDim",FractalDimension(Price,30),NEW,RED);

plot("ShannonGain",ShannonGain(Price,40),NEW,RED);

}

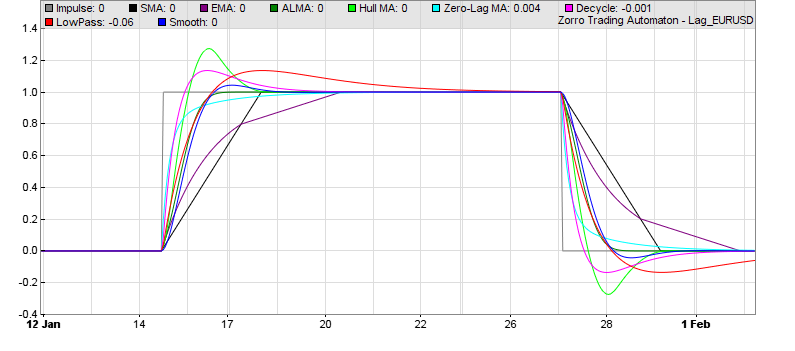

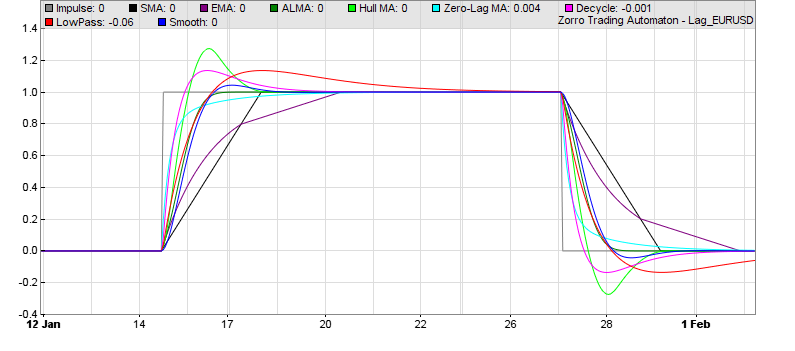

// compare the impulse responses of some low-lag MAs

function run()

{

set(PLOTNOW);

BarPeriod = 60;

MaxBars = 500;

LookBack = 150;

asset(""); // dummy asset

ColorUp = ColorDn = 0; // don't plot a price curve

PlotWidth = 800;

PlotHeight1 = 400;

vars Impulse = series(1-genSquare(400,400));

int Period = 50;

plot("Impulse",Impulse[0],0,GREY);

plot("SMA",SMA(Impulse,Period),0,BLACK);

plot("EMA",EMA(Impulse,Period),0,0x800080);

plot("ALMA",ALMA(Impulse,Period),0,0x008000); // best representation of the impulse

plot("Hull MA",HMA(Impulse,Period),0,0x00FF00);

plot("Zero-Lag MA",ZMA(Impulse,Period),0,0x00FFFF); // fastest MA with no overshoot

plot("Decycle",Decycle(Impulse,Period),0,0xFF00FF); // fastest MA with some overshoot

plot("LowPass",LowPass(Impulse,Period),0,0xFF0000);

plot("Smooth",Smooth(Impulse,Period),0,0x0000FF);

}

See also:

Spectral filters, Time series,

Normalization, Candle patterns,

Machine learning

►

latest version online