optimize (var default, var min, var max, var step, var bias) : var

Optimizes a trading strategy parameter for the current asset and

algo combination. In [Test] and [Trade]

mode the function returns the previously optimized parameter value. In [Train]

mode the function performs an optimization process to find the most robust

parameter value between min and max.

Several optimization methods (Ascent, Genetic, Brute Force, Extern) are available through

TrainMode. The optimization target can be individually defined

with a user-supplied objective function. The optimization process

consists of many cycles. For every cycle the optimize function

generates a different value between min and max

and tests its effect on the strategy. At the end of the optimization, a parameter

chart is plotted that reveals the effect of a certain parameter on the strategy

(see below). The best

or most robust parameter values are then selected and stored in a .par

file.

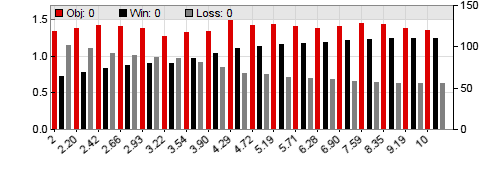

The chart above is a result of a parameter optimization with the

Ascent algorithm. The parameter is a stop distance. It varies from

2 to 10

in 10% steps. At any step the number of

winning trades (black bars), losing trades (grey) and performance

(red) of the parameter are displayed. We can see that high stop distances

increase the number of winning trades, but have only a small effect on the

overall performance. The Ascent optimizer would here likely select 8

as the most robust parameter value, rather than the single peak at 4.29.

This behavior can be changed

with TrainMode.

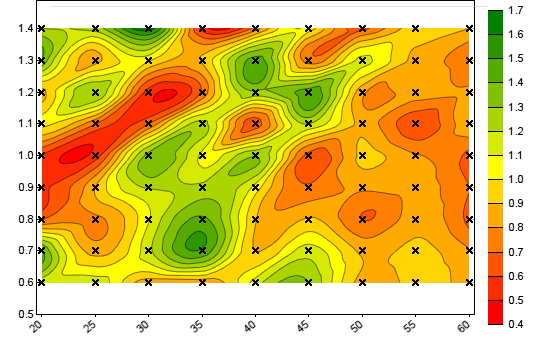

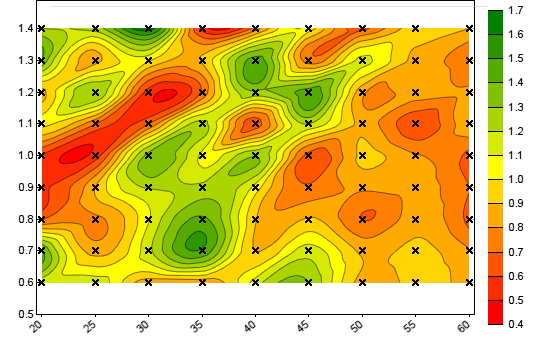

The contour chart above is generated by optimizing two parameters with the

Brute Force algorithm. The first parameter, a time period, runs from

20 to

60 in steps of 5; the second, a signal

threshold, from 0.6 to 1.4. Green areas indicate high performance, red areas

low performance of the parameter combination. The optimizer would here likely

select the 35 / 0.8 parameter combination. If more than two

parameters are optimized, the first two are used for the contour chart.

The size of parameter or contour charts can be set up with

PlotHeight2. By using multiple optimize calls in the code, any number of parameters

can be optimized (up to 16 per asset/algo component). The more parameters, the more trades are needed for a

meaningful optimization, and the longer will it take. As a rule of thumb, have

at least 40 trades per parameter and WFO cycle, and do not optimize more than 3 or 4 parameters

for a trade entry signal and 2 or 3 for exit. Too many optimized parameters generate an overfitted

strategy and reduce the out-of-sample performance. Dependent on the method, the best value

of a parameter can affect the optimization of the next parameters. If the script

contains loop calls,

a separate parameter set for the asset/algo combination in each loop is optimized.

Training also produces a log with the results of any training step. Here's an

example log of the first cycle of an Ascent parameter walk-forward optimization:

Walk[1] Bar 400..23372

Parameter 1 step 1: 0.10 => 0.96 1729/1933

Parameter 1 step 2: 0.20 => 0.91 1290/1540

Parameter 1 step 3: 0.30 => 0.87 990/1184

Parameter 1 step 4: 0.40 => 0.83 840/1034

Parameter 1 step 5: 0.50 => 1.06 747/759

Parameter 1 step 6: 0.60 => 1.01 669/715

Parameter 1 step 7: 0.70 => 0.87 604/712

Parameter 1 step 8: 0.80 => 0.86 490/616

Selected p1[5] = 0.504 => 0.96

Parameter 2 step 1: 1.00 => 1.06 471/1035

Parameter 2 step 2: 1.50 => 1.08 553/953

Parameter 2 step 3: 2.00 => 1.08 599/907

Parameter 2 step 4: 2.50 => 1.07 646/860

Parameter 2 step 5: 3.00 => 1.06 676/830

Parameter 2 step 6: 3.50 => 1.07 725/781

Selected p2[3] = 2.000 => 1.07

Parameter 3 step 1: 1.00 => 0.97 883/623

Parameter 3 step 2: 1.50 => 0.99 806/700

Parameter 3 step 3: 2.00 => 1.02 755/751

Parameter 3 step 4: 2.50 => 1.06 711/795

Parameter 3 step 5: 3.00 => 1.04 657/849

Parameter 3 step 6: 3.50 => 1.06 622/884

Selected p3[5] = 3.01 => 1.05

EUR/USD: 0.504 2.000 3.01=> 1.112

Parameters stored in OptTest_1.par

The log displays the first

walk-forward cycle (Walk[1]) with 3 parameters. The numbers after '=>'

are the objective return value and the numbers of

won and lost trades. The selected parameter value and its objective are

interpolated between steps. The second-last line, beginning with "EUR/USD:",

is the content added to the parameter file.

Parameters:

| default |

Default value of the parameter, returned when the

PARAMETERS flag is not set in [Test] or [Trade]

mode. This should be the estimated best value of the parameter, normally

in the middle of its range. Must be >= 0. |

| min, max |

Parameter range, minimum and maximum values (>=

0). For optimizing negative parameter ranges, subtract an

offset or add a minus sign to the optimize call. If

both min and max are 0, the default

value is

stored in the parameter file. |

| step |

Optional step width. If at 0 or omitted, in

Ascent

optimization 10%

is added to the parameter for every step; in Brute Force or

Genetic optimization

1/10 of the min..max range is added. A positive step

value is added at every step.A negative step

value is interpreted as a percentage to be added, for instance

-20 adds 20% per step (Ascent

optimization only). Using a percentage

gives a higher step resolution to smaller values at the begin

of the range. For best results, select the step value so

that every parameter has about 10..15 optimization steps. The recommended

minimum number of steps is 5, the maximum number of steps

(MAX_STEPS) can be found in trading.h. |

| bias |

Optional preference of low or high parameter values (Ascent

optimization only). When 0 or omitted, select the optimal

parameter. When > 0, prefer higher parameter values

even when their rank is lower by the given bias in percent.

When < 0, prefer lower parmeter values even when their

rank is lower by abs(bias) in percent. Preferring values

from the low or high range can make sense f.i. for setting a Stop

as tight as possible even when its value is not optimal. |

Returns

Current, default, or optimized parameter value, depending on training or test/trade

mode.

Remarks:

- A bit of optimization theory is described under Training;

for examples see Workshop 5 and

Workshop 6. More about optimization tricks

and traps can be found in the Black Book.

- All optimize calls must be placed either in the

run function or in functions that are called from the

run function. Since parameters are identified by the order

of their optimize calls, the order must not change between test and training or from one

run to the next. All flags and variables that affect optimization, such as

PARAMETERS, NumTrainCycles,

TrainMode, etc. must be set and an asset must be selected before the first

optimize call.

- In portfolio strategies, parameters

should be normally optimized separately

for any component. Use one or two loop() calls

to cycle through all used assets and algos. For optimizing asset/algo

specific parameters, place the

optimize calls inside the inner loop, and

make sure to select

asset and algo before. For optimizing

additional global parameters that do not depend on asset and algo,

place their optimize

call

in the very first loop run only, and store the parameter in a static or

global variable outside the loop. The global parameters are then assigned to the

first asset and/or algo. If asset/algo

specific optimization is not desired at all, don't use loop,

but enumerate the assets in a simple

for loop, f.i. for(used_assets) ...,

and optimize the parameters outside the for loop. Make sure in that case to select

all assets before the first optimize call; otherwise the optimizer

will assume a single-asset strategy.

- The optimization objective is calculated

from trade statistics by the

objective function in include\default.c.

This function can be replaced by any user provided function named objective

in the script. This way, arbitrary performance figures can be used for optimizing

parameters, for instance the profit/drawdown ratio, or the gross profit, or

the Sharpe ratio. The objective function can

access all trade statistics for determining the performance

value. By default, the function calculates the pessimistic return ratio (PRR)

with reduced influence of the biggest win and the biggest loss, a penalty for

few trades, and a 5 trades minimum.

- Optimized parameters are stored in .par files in the

Data folder. They are plain text files that contain the parameter

values in the order of their optimize calls. If

WFO was used, the WFO cycle is appended to

the file name. If optimize was called without selecting an

asset before, the file names contain the current

asset from the [Asset] scrollbox. This way different sets of .par files can

be generated with the same script by training different assets from the

AssetsFix list. The script must then not modify the

scrollbox by assetSelect or

assetList, otherwise inconsistent .par file names will

cause error messages. In that case make

sure to select a valid asset by script before the first optimize

call.

- In multi-asset or multi-algo strategies

the .par files contain the parameters for all asset/algo combinations,

and the

.par file name does not contain the asset name.

Each line in a portfolio .par file begins with the asset name and optional

algo identifier of the parameter set. The values

are listed in the order of the optimize calls in the script.

A '+' before a parameter value indicates that the best

value is at the end of its parameter range. In that case it could make sense

to extend the range for better results.

- If the PARAMETERS flag is not set, the

optimize call will return the default value in [Test]

or [Trade] mode, and a previously optimized

parameter from the .par file in [Train]

mode. This allows to temporarily switch off the PARAMETERS

flag for special purposes, such as a training run with FACTORS only.

- For eliminating distortions by money management, optimization uses normally

a fixed 1 lot trade size and includes

any phantom trades. Margin

or Lots have no effect, except when they are zero; in

that case no trade is opened. Training with individual lot sizes for special purposes can be

set up with the TrainMode variable.

- For best precision and proper display on charts, parameters should be

in the positive integer range, i.e. between 1

and 10000. Thus, 0.012345 or 1.23e45 would be no good parameter values. Multiply them with a factor when

smaller or higher numbers are needed. If a parameter has to be negative,

multiply it with -1 or subtract

a constant for getting a positive range. For optimizing in pre-defined individual steps, use an array and optimize

its index. Example: int Periods[5] = { 10, 20, 50, 100, 200 }; int Period

= Periods[round(optimize(1,0,4,1),1)];

.

- For using no optimization for a certain parameter, but

calculating it by script in the training run

instead, set min and max at 0 and

default at the calculated value (f.i. MyParameter =

optimize(MyCalculatedValue,0,0);). The default is

then stored in the .par file, This way parameters can be

generated in the training run that would be difficult to get in live

trading, for instance the average volatility of the last 10 years.

- Returned parameter values in Ascent mode are

not a multiple

of the step width. They can lie anywhere in the optimization range. Use the

round or floor functions when

optimizing an integer value.

- The bias value can be used when a high or a low value of

the parameter is preferred even though another value gives a slightly better

objective result (Ascent mode only). For instance, you might

prefer low stop distances to reduce the risk even when higher stop distances

give slightly better results.

- Parameters that affect the bar composition, such as

BarMode,

BarPeriod, or bar

ranges, cannot be directly optimized

because bars are generated at the begin of the simulation. If needed, optimize them

by script in several cycles, then enter

their optimal value directly in the script.

- When optimizing several parameters in Ascent mode,

put the most important parameters first. Parameters are optimized in the order

they appear in the code. For optimizing trade entry and exit parameters, optimize

entry parameters first and exit parameters afterwards. Use a distant exit as

default value for optimizing the entry. When your exit system

is very complex, optimize entry parameters with a simplified exit such as a

distant

stop. For using a different exit system while the entry parameters are optimized, evaluate

the current parameter number (ParCycle),

f.i. if(Train && ParCycle <= NumParameters-3) setExitSimple();.

- When parameters affect each other - for instance, two time periods for a crossover

of two moving averages - optimize only one time period, and optimize a multiplication

factor for the other (see the example below). This way the other time period

also changes when the first one is optimized.

- Special cases when RULES and PARAMETERS

have to be optimized at the same time are described under

Training. For optimizing parameters several times,

use NumTrainCycles. The current optimization cycle can be evaluated with the

ParCycle and

StepCycle

variables. Optimization can be aborted by setting StepNext

to 0. This will end optimization of the current parameter after the current cycle.

- When optimizing a time period of an indicator, make sure that

LookBack is set at least to the maximum

period plus the UnstablePeriod (f.i. LookBack = max(LookBack,300);).

Otherwise LookBack will automatically adapt to the period of

the current parameter value. This would affect the result in an unexpected way

because the backtest period would then get shorter when the time period gets

longer.

- For avoiding randomness, slippage is not simulated

during optimization. Rollover is simulated; it can

have a large effect on the result and produce long/short asymmetry in parameters

and profit factors. For eliminating rollover asymmetry, you can set

RollLong/Short to 0 after calling

asset in training mode. For eliminating trend asymmetry,

detrend the price curve in training mode. Even without

rollover and trend, some commodities and stocks still require different parameter

sets for long and short trades due to inherent asymmetries in their price curves

(long trades are often dominant).

- When the strategy opens no trades at all in [Train]

mode - f.i. when no trade signal is generated or when Margin

or Lots is zero - the default values

are stored in the parameter file.

- The profit/loss curves of every optimize

step can be exported in a file for further evaluation when a

Curves file name is given. A curve is only exported

when the objective function returns a nonzero value. A CSV

file with all parameter combinations and their objectives are exported in

brute force, genetic, or extern optimization mode when

LOGFILE is set. Parameter charts are

generated when LOGFILE is set and multiple

cores or multiple cycles

are not used. The height of the parameter charts can be controlled with

PlotHeight2.

- While training, trades are normally not logged. For

logging the trades of a particular training

cycle, use the LogTrainRun variable.

Examples:

// trend trading with Moving Averages and optimized parameters

function run()

{

set(PARAMETERS);

// for optimizing time periods, set the LookBack variable to the

// maximum possible value (here, TimeCycle 100 * TimeFactor 5)

LookBack = 100*5;

var TimeCycle = optimize(30,10,100,5);

var TimeFactor = optimize(3,1,5);

// allow 3% tolerance for preferring low stop distances

Stop = ATR(10) * optimize(3,1,10,0.5,-3);

vars Price = series(price(0));

vars MA1 = series(SMA(Price,TimeCycle));

vars MA2 = series(SMA(Price,TimeCycle*TimeFactor));

plot("MA1",*MA1,0,BLUE);

plot("MA2",*MA2,0,BLUE);

if(crossOver(MA1,MA2))

enterLong();

else if(crossUnder(MA1,MA2))

enterShort();

}

See also:

Training, TrainMode,

loop, NumParameters,

NumTrainCycles, Workshop

5, Statistics

►

latest version online