This is

not a

Trading

Platform.

But it beats any.

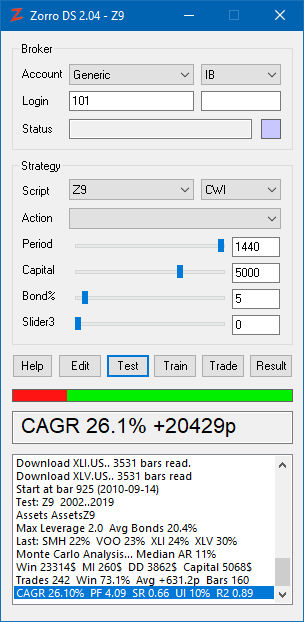

Zorro is a free institutional-grade software tool for data collection, financial research, and algorithmic trading with C/ C++. It's compact, portable, easy to learn, and magnitudes faster than R or Python. It does anything that automated trading platforms do - only better. Zorro offers extreme flexibility and features otherwise not found in consumer trading software.

Any data analysis, visualization, or algo trading system can be realized with a small C or C++ script (see script examples). R and Python machine learning libraries are also supported. Tutorials and video courses get you quickly started, even with no prior coding knowledge. Otherwise request a quote for outsourcing your algo trading strategies.

Zorro is a free institutional-grade software tool for data collection, financial research, and algorithmic trading with C/ C++. It's compact, portable, easy to learn, and magnitudes faster than R or Python. It does anything that automated trading platforms do - only better. Zorro offers extreme flexibility and features otherwise not found in consumer trading software.

Any data analysis, visualization, or algo trading system can be realized with a small C or C++ script (see script examples). R and Python machine learning libraries are also supported. Tutorials and video courses get you quickly started, even with no prior coding knowledge. Otherwise request a quote for outsourcing your algo trading strategies.

Access to all markets.

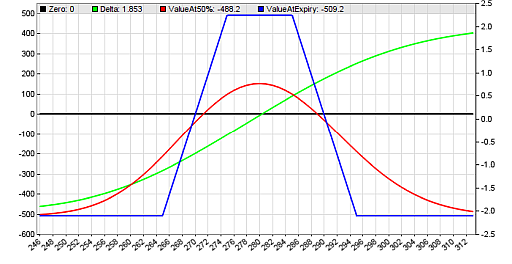

Financial markets are all different, but Zorro is universal. It can simultaneously connect to multiple data feeds, banks, brokers, or exchanges. It has modules for options, futures, stocks, ETFs, CFDs, Forex, and cryptocurrencies. It can apply machine learning, fuzzy logic, mean-variance optimization, pattern detection, or order book analysis for trading algorithms.

On time scales from milliseconds to weeks, Zorro supports a wide range of algo trading methods from high-frequency trading (HFT) to monthly portfolio rotation.

Financial markets are all different, but Zorro is universal. It can simultaneously connect to multiple data feeds, banks, brokers, or exchanges. It has modules for options, futures, stocks, ETFs, CFDs, Forex, and cryptocurrencies. It can apply machine learning, fuzzy logic, mean-variance optimization, pattern detection, or order book analysis for trading algorithms.

On time scales from milliseconds to weeks, Zorro supports a wide range of algo trading methods from high-frequency trading (HFT) to monthly portfolio rotation.

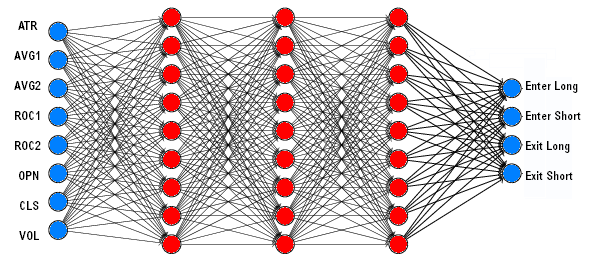

Human and artificial intelligence.

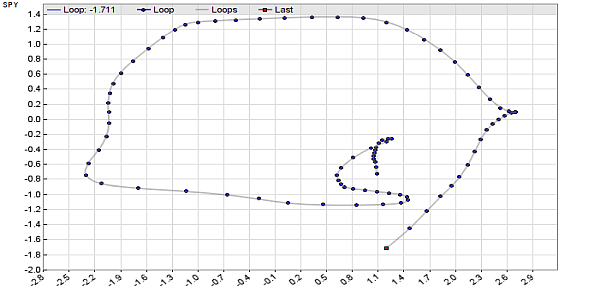

Define a deep learning architecture and apply it like a simple indicator. Zorro can utilize deep neural networks or any other R or Python based machine learning libraries for algo trading systems.

Add human intelligence. Retrieve market sentiment by analyzing option chains, order flow, blockchains, news sources, or online reportts.

Define a deep learning architecture and apply it like a simple indicator. Zorro can utilize deep neural networks or any other R or Python based machine learning libraries for algo trading systems.

Add human intelligence. Retrieve market sentiment by analyzing option chains, order flow, blockchains, news sources, or online reportts.

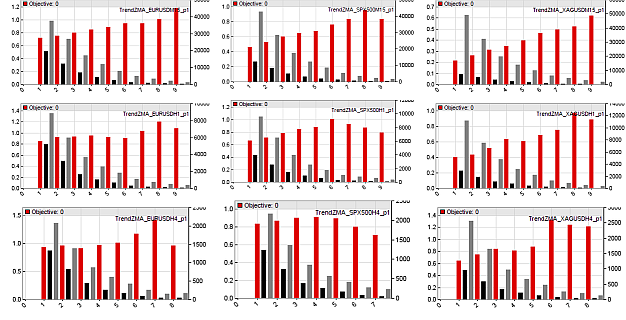

Serious optimizing.

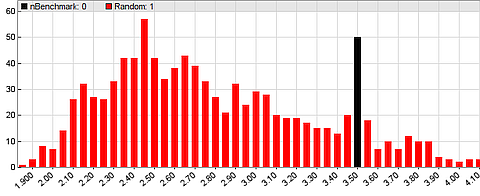

Optimizing can determine a strategy's robustness and adapt it to different markets. Zorro's walk-forward optimizer trains a 12-parameter intraday portfolio system in less than 25 seconds. Histograms and contour charts illustrate the effect of any parameter on the strategy.

Multiple optimization methods with user-defined algorithms and training objectives are supported. Live trading systems can automatically re-train themselves in regular intervals.

Optimizing can determine a strategy's robustness and adapt it to different markets. Zorro's walk-forward optimizer trains a 12-parameter intraday portfolio system in less than 25 seconds. Histograms and contour charts illustrate the effect of any parameter on the strategy.

Multiple optimization methods with user-defined algorithms and training objectives are supported. Live trading systems can automatically re-train themselves in regular intervals.

Serious backtesting.

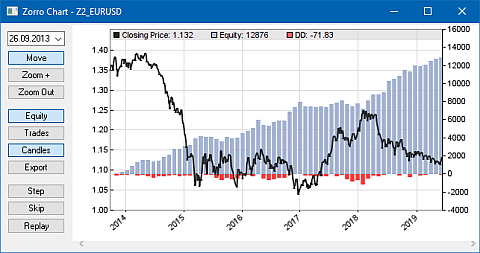

Zorro's tick-level backtest module needs only 0.3 seconds for a 10-years test. After all, it's C++. Exchanges, brokers, and accounts are accurately simulated by their symbols, leverages, commissions, NFA or FIFO compliances, and other parameters. Tests can use ticks, standard bars, or any sort of special bars.

The visual debugger allows replaying the backtest or stepping into details. Results are validated with walk-forward analysis, Montecarlo simulation, and reality checks with randomized price curves.

Zorro's tick-level backtest module needs only 0.3 seconds for a 10-years test. After all, it's C++. Exchanges, brokers, and accounts are accurately simulated by their symbols, leverages, commissions, NFA or FIFO compliances, and other parameters. Tests can use ticks, standard bars, or any sort of special bars.

The visual debugger allows replaying the backtest or stepping into details. Results are validated with walk-forward analysis, Montecarlo simulation, and reality checks with randomized price curves.

Data analysis.

Developing a trading algorithm begins with analyzing a market inefficiency and detecting its traces in online data or price curve anomalies. Any such anomaly can be exploited in an algo trading system.

Zorro can collect online data by website scraping or API access, convert it from any imaginable format, analyze it, visualize it, and use it for a trading algorithm or machine learning network.

Developing a trading algorithm begins with analyzing a market inefficiency and detecting its traces in online data or price curve anomalies. Any such anomaly can be exploited in an algo trading system.

Zorro can collect online data by website scraping or API access, convert it from any imaginable format, analyze it, visualize it, and use it for a trading algorithm or machine learning network.

Instant strategies.

Zorro comes with ready-to-run, indicator-free trading systems for Forex, CFDs, ETFs, stocks, options, and cryptocurrencies. They are permanently maintained and allow you to experience a live trading system before developing your own strategies. Read here about the free algo trading systems.

Be aware that the future is unknown and all strategies are risky. Invest no money you can't afford to lose.

Zorro comes with ready-to-run, indicator-free trading systems for Forex, CFDs, ETFs, stocks, options, and cryptocurrencies. They are permanently maintained and allow you to experience a live trading system before developing your own strategies. Read here about the free algo trading systems.

Be aware that the future is unknown and all strategies are risky. Invest no money you can't afford to lose.

All is customizable.

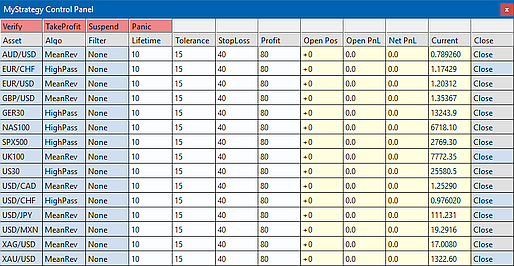

Design your project's user interface. Define buttons, lists, displays, sliders, entry fields, charts, and reports by script or with a spreadsheet.

Put Zorro on a server and control it with PHP. Automate Zorro jobs with batch processes. Integrate Zorro in third party software with its DLL interface. Implement your own broker APIs or feed protocols. Verify the live trading status from anywhere with individualized online reports.

Design your project's user interface. Define buttons, lists, displays, sliders, entry fields, charts, and reports by script or with a spreadsheet.

Put Zorro on a server and control it with PHP. Automate Zorro jobs with batch processes. Integrate Zorro in third party software with its DLL interface. Implement your own broker APIs or feed protocols. Verify the live trading status from anywhere with individualized online reports.

Why C / C++?

Because speed is important for a trading system - especially for training, optimizing, and backtesting. C is the fastest high-level language: 3 times faster than C#, 20 times faster than Python, and 100 times faster than R. Its easy syntax allows a fast approach to strategy coding and results in very short scripts.

Use the integrated on-the-fly compiler for rapid development, or the Microsoft Visual Studio™ environment for coding in C++. Functions and libraries coded in R or Python can be called from C or C++ scripts.

Because speed is important for a trading system - especially for training, optimizing, and backtesting. C is the fastest high-level language: 3 times faster than C#, 20 times faster than Python, and 100 times faster than R. Its easy syntax allows a fast approach to strategy coding and results in very short scripts.

Use the integrated on-the-fly compiler for rapid development, or the Microsoft Visual Studio™ environment for coding in C++. Functions and libraries coded in R or Python can be called from C or C++ scripts.

Why free?

Zorro is free for private traders since its development was partially donated. Our sponsor believed that all people, especially in developing countries, should learn programming and participate in the financial markets. They need easily accessible algo trading software that really works.

The idea: Small but regular trading incomes for anyone take liquidity out of the financial system and inject it back into the production cycle. This can boost worldwide demand and reduce the divide between rich and poor.

Zorro is free for private traders since its development was partially donated. Our sponsor believed that all people, especially in developing countries, should learn programming and participate in the financial markets. They need easily accessible algo trading software that really works.

The idea: Small but regular trading incomes for anyone take liquidity out of the financial system and inject it back into the production cycle. This can boost worldwide demand and reduce the divide between rich and poor.

Allow Zorro to beat the world's financial system with its own weapons. Understand, analyze, experiment with, and exploit the markets with many different ideas and methods.

While the markets are evolving, Zorro's development is ongoing, funded through sponsor licenses, development contracts, and trading returns. New versions come out every 3-4 months.

"Take Money From The Rich And Give It To The Poor"