Option Combos

The functions below can be used for

handling combinations of options, such as Spreads, Straddles,

Strangles, Condors, Butterflies, etc. Option combos are mainly used for limiting

risk. For an introduction to options trading, see

Financial Hacker.

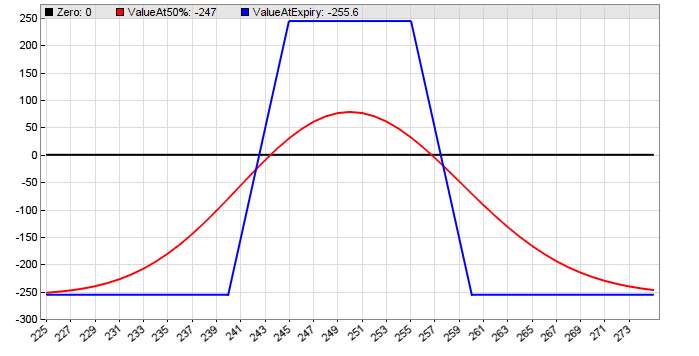

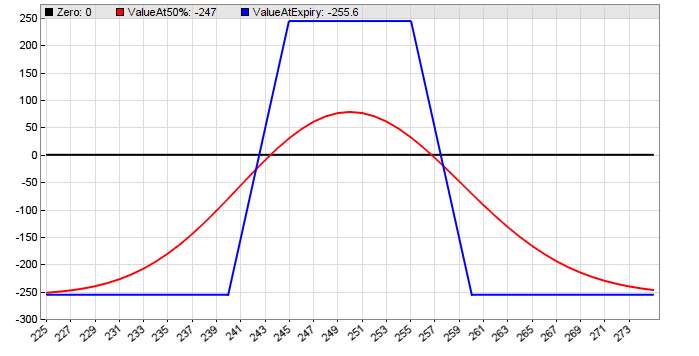

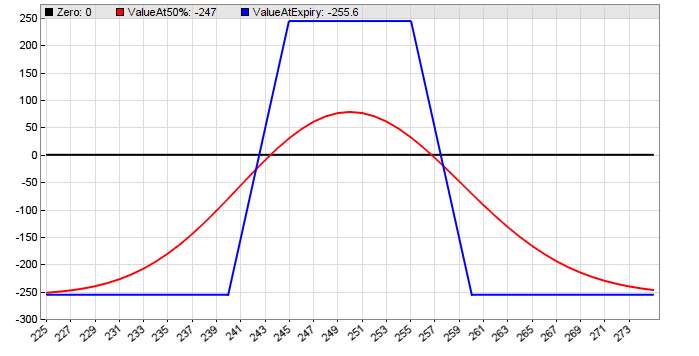

The image below shows the profit or loss of an Iron Condor combo dependent of

the underlying price, at expiration (blue) and halfway to expiration (red).

Iron Condor payoff

diagram (Payoff.c)

combo (CONTRACT* C1, int N1, CONTRACT* C2, int N2, CONTRACT* C3, int N3,

CONTRACT* C4, int N4): int

Combines 2, 3, or 4 option contracts C1..C4 to a combo. The number

and trade direction of contracts are given by N1..N4; use negative

numbers for selling and positive numbers for buying, f.i.

-2 for short selling two contracts. C3/N3

and C4/N4

can be 0 for combos with only 2 or 3 legs. Returns the number of combo legs, i.e. the number of different contracts of the

combo. If all numbers N are 0, or if any CONTRACT* pointer is zero while

its associated

number N is nonzero, the combo is disabled and the function returns

0. Source code in contract.c.

comboAdd (CONTRACT* C, int N): int

Adds a copy of the option contract C to the current combo. Amount

and trade direction of the contract is given by N; use a negative

number for selling and a positive number for buying. Returns the number of

the current combo leg. If C is 0, the function deletes all contracts from

the combo and returns 0.comboLegs (): int

Returns the number of legs of the current combo that was defined before with

combo() or comboAdd() calls.

comboContract (int Leg): CONTRACT*

Pointer to the CONTRACT struct of the combo leg with the given

number (1..4). Macro defined in contract.c.

comboLeg (int Leg): int

Selects the contract of the combo leg with the given number (1..4), and returns

the number assigned to that contract as defined in the

combo() function. The number is negative for selling and positive for

buying, so it can be directly used for the Lots parameter

passed to enterLong.

comboStrike (int Leg): var

Returns the strike value of the given combo Leg (1..4).

Source code in contract.c.

comboProfit (var Price, int Sign): var

Returns the profit or loss of the current bought (Sign == 1) or

sold (Sign == -1) combo when expiring at the given Price.

Type, fAsk, and fBid of all contracts of the combo must be set, so

contractPrice should have been called before; the other contract

parameters don't matter. Multiplier and transaction costs are not included. Source code in contract.c.

comboRisk (int Sign): var

Returns the maximum possible loss of the current bought (Sign == 1) or

sold (Sign == -1) combo. For combos with unlimited loss,

returns the loss when the price drops to zero or ends up at twice the strike,

whichever is worse. Type, fAsk, fBid,

and fStrike of all contracts of the combo must be set, so

contractPrice must have been called before; the other contract

parameters don't matter. Multiplier and transaction costs are not included. Source code in contract.c.

comboPremium (int

Sign): var

Returns the premium of the current bought (Sign == 1) or

sold (Sign == -1) combo, also referred to as the combo's ask

and bid price. Positive premium is earned, negative

premium is paid. If the combo consists of long and short positions, its ask

price can be lower than its bid price. fAsk and fBid of all

contracts of the combo must be set, so contractPrice

should have been called before; the other contract parameters don't matter. Multiplier

and Transaction costs are not included. Source code in contract.c.comboType ():

int

Returns the combo type: 1 for a single put, 2

for a single call, 6 for a call spread, 7 for a strangle (call and put),

8 for

a put spread, 13

for a call butterfly (3 calls), 14 for a put butterfly (3 puts),

and

20 for a 4-contract combo such as a condor (2 calls and 2 puts). Source code in contract.c.comboMargin (int

Sign, int AssetType): var

Calculates the margin cost of the current bought (Sign == 1) or

sold (Sign == -1) combo with the given AssetType.

Uses the margin formula on the Interactive Broker's

US Options Margin Requirements page. Supports single calls and puts, call

spread, put spread, strangle (call and put), Butterfly with 3 calls, Butterfly

with 3 puts, and Condor (2 calls and 2 puts). Source code in

contract.c.

Parameters:

| C1..C4 |

CONTRACT* pointer for leg 1..4, or 0 when the leg is not used

in the combo. |

| N1..N4 |

Number of contracts for leg 1..4, negative for selling and positive for

buying contracts. 0 when the leg is not used in the combo. |

| Leg |

Number of the combo leg, 1..4, starting with 1

for the first contract. |

| Sign |

Position sign, -1 for short and 1 for

long. |

| AssetType |

1 for a currency, 2 for an index,

3 for stocks and ETFs. The margin for futures must be

individually calculated. |

comboPrint (int To)

Prints the parameters of the current combo contracts to the destination

To, as in print(To,...).

plotCombo (var HistVol, var Min, var Max, int Days, int

Modus)

Plots the payoff diagram of the current combo

with volatility HistVol from price Min to

price Max. Modus 0 initializes the plot and

plots a zero line, Modus 1 plots the diagram at expiration,

Modus 2 at the given Days into the lifetime (R

and RQuantLib

required), and Modus 3 plots the Delta. Type, strike, ask, bid,

and expiry in days must be set in all contracts of the combo. Two different

expiration periods are supported. Source code in contract.c;

usage example in PayOff.c.

Remarks:

- contract.c must be included for all above functions.

- Combo trades should be opened or closed in the order of legs, starting

with leg 1. They are then automatically combined to a combo order which is sent to the broker

with the last leg.

Many brokers offer reduced margin and commission on combos. The combo order

internally uses the SET_COMBO_LEG command,

which must be supported by the broker plugin. Otherwise the combo is split

in separate contract orders. Make sure that all legs of the combo are

entered together; "pending

legs" won't work.

- Order limits are normally interpreted by the

broker as a price limit of the whole combo. The Stop

variable affects individual legs; closing the whole combo at a certain loss

must be handled by script.

- Combos orders can take several minutes for being executed, even at

market. For this reason it is recommended to use GTC

orders and/or to increase the wait time with the

SET_WAIT command.

- If a combo order is not opened by the broker, the

enter call with the last leg will fail. In that case cancel the

preceding legs with the cancelTrade function.

- The elements of the current combo can be accessed through the

ThisCombo pointer, defined in trading.h.

- The current combo remains valid until the next combo()

or contractUpdate() call.

- Use the algo function for getting separate

combo-specific statistics. For determining the current profit/loss of a

combo position, use a trade loop and sum up all

TradeProfit of the same

TradeAlgo. Trades of the same combo are listed in sequence in the trade

loop.

- The script Payoff.c contains definitions of

often used combos, such as spread,

strangle, butterfly,

condor. You can

enter an individual combo for plotting its profit/loss curve.

- For brokers with a different combo margin structure, the

comboMargin function can be copied from contract.c

into the strategy script and accordingly modified.

Example (see also Workshop 8 and Payoff.c):

if(combo(

contract(CALL,Days,Strike),1,

contract(PUT,Days,Strike),1,

0,0,0,0)) // Strangle combo

{

enterLong(comboLeg(1));

enterLong(comboLeg(2));

}

See also:

contract, contract variables,

Workshop 8

► latest version online