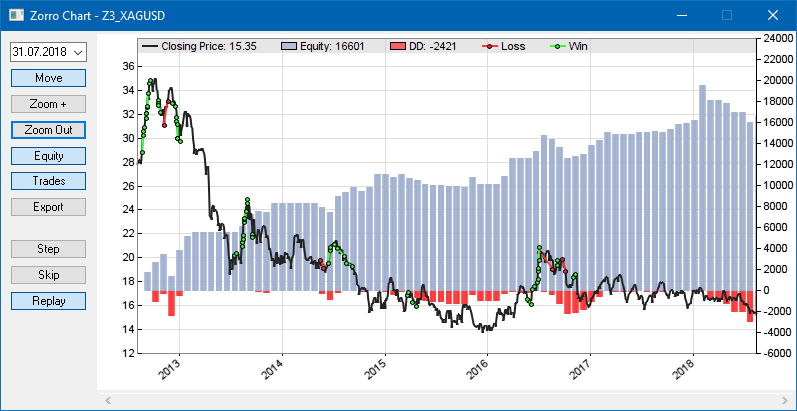

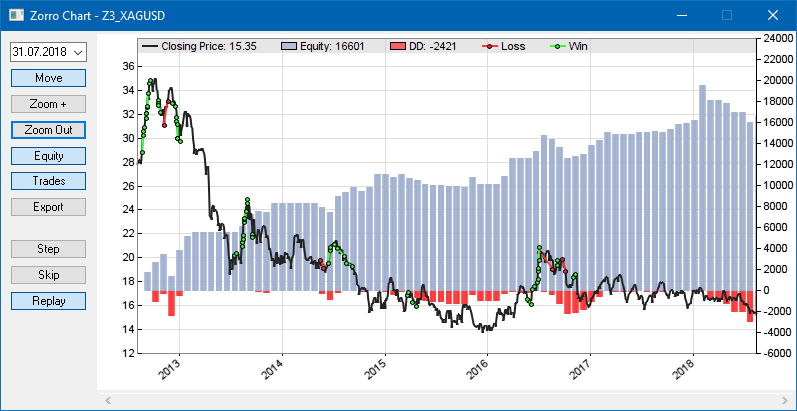

Zorro can analyze the performance of its own strategy scripts, and also strategy results from other platforms that are imported from .csv trade lists. A click on [Result] after a test run produces a chart, a log, a trade list in CSV format, and a performance report with portfolio analysis. Chart images and reports are stored in the Log folder and can be displayed with Zorro's image viewer or text editor. Exported charts are .png image files, generated reports are simple .txt files. This way they can be easily posted to websites, imported in documents, exported to spreadsheets, or further evaluated with the Performance script. Additionally, datasets from charts can also be exported and further evaluated with third party software, f.i. an R data analysis package.

During a session, the performance report is available through the report function. In [Trade] mode the chart and performance report is part of the .htm status page. It can be displayed in a web browser and is updated every minute. It also contains a list of all open and pending trades, as well as any specific information that is printed by the script.

This is an example of a performance report:

Walk-Forward Test Z4 portfolio Simulated account AssetsFix.csv (NFA) Bar Period 4 hours (avg 266 min) Simulation period 06.06.2007-02.12.2017 (9483 bars) Test period 10.06.2010-02.12.2017 (6259 bars) WFO test cycles 11 x 569 bars (137 days) WFO training cycles 12 x 3224 bars (111 weeks) Lookback period 700 bars (169 days) Monte Carlo cycles 200 Fill mode Realistic (slippage 5.0 sec) Avg bar 5.1 ticks 470.5 pips range Spread 0.7 pips (roll -0.70/-0.31) Lot size 1.0 Capital invested 5000$ Gross win/loss 90452$-73672$, +20252p, lr 16325$ Virtual win/loss 90024$-74112$ Average profit 5309$/year, 459$/month, 27$/day Max drawdown -2025$ 12% (MAE -2287$ 14%) Total down time 78% (TAE 93%) Max down time 119 days from May 2011 Max open margin 656$ Max open risk 1863$ Trade volume $10164943 (2610626$/year) Transaction costs -637$ spr, -365$ slp, -906$ rol, -1102$ com Capital required $2681 Number of trades 1370 (351/year) Percent winning 44% Max win/loss 810$ / -407$ Avg trade profit 12$ 10.4p (+99.0p / -56.5p) Avg trade slippage -0.27$ 0.2p (+1.1p / -1.4p) Avg trade bars 16 (+23 / -10) Max trade bars 141 (34 days) Time in market 355% Max open trades 14 Max loss streak 17 (uncorrelated 13) Annual return 161% Profit factor 1.38 (PRR 1.28) Reward/Risk ratio 10.5 Sharpe ratio 1.94 (Sortino 1.98) Kelly criterion 0.63 Ulcer index 12% Scholz tax 14026 EUR Cycle performance 1.39 1.40 1.31 1.33 1.37 1.38 Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total% 2010 -2 20 -16 20 -13 22 10 -8 8 +38 2011 -1 15 15 -9 26 -1 -1 13 6 28 1 1 +135 2012 2 -9 21 1 3 -2 -0 3 1 0 7 13 +51 2013 6 13 -7 -4 9 6 -8 -4 0 1 -2 -8 -3 2014 6 3 0 -0 4 -2 3 -6 8 12 -9 5 +23 2015 5 -7 8 13 -1 0 0 1 3 -1 -5 -12 +17 2016 19 1 6 9 6 -10 10 3 1 -1 6 -2 +30 2017 -1 -7 6 -5 0 -0 -1 2 1 -5 -1 7 -6 Confidence level AR DDMax Capital 10% 236% 1440$ 1390$ 20% 227% 1550$ 1470$ 30% 218% 1680$ 1570$ 40% 209% 1830$ 1680$ 50% 202% 1940$ 1760$ 60% 193% 2140$ 1900$ 70% 186% 2340$ 2040$ 80% 174% 2730$ 2320$ 90% 166% 3080$ 2580$ 95% 146% 4010$ 3580$ 100% 104% 5640$ 4710$ Portfolio analysis OptF ProF Win/Loss Wgt% Cycles AUD/USD avg .014 1.36 281/475 11.4 XXXXXXXXXX/ EUR/USD avg .006 1.41 91/115 6.2 XXXXXX\XXXX GER30 avg .030 1.33 34/45 2.5 X/X/\.\XXXX SPX500 avg .077 1.75 96/162 16.4 XXXXXXXXXXX USD/JPY avg .006 1.69 130/175 8.7 XXXXXXXXXX/ XAG/USD avg .008 1.35 113/152 5.3 \\XXXXXXXX/ BB avg .010 1.29 82/111 2.6 X/\XXX/\XXX CT avg .019 1.38 106/126 7.6 XXXX\XXXXXX CY avg .017 1.83 60/66 5.6 /XXX\/XXX/X ES avg .025 1.34 163/275 7.4 XXXXX/XXXXX HP avg .017 1.34 332/440 19.2 XXXXXXXXXXX LP avg .009 1.54 106/219 11.3 \XXXXXXXXXX VO avg .014 1.71 217/288 24.2 /XXXXXXXXXX AUD/USD:ES .036 1.14 45/87 0.1 \\/\\//\\// AUD/USD:ES:L .036 1.14 45/87 0.1 \\/\\//\\// AUD/USD:ES:S .000 ---- 0/0 0.0 ........... AUD/USD:HP .024 1.18 76/102 2.2 X/\XX\/XX\/ AUD/USD:HP:L .024 1.13 47/68 1.2 //./\\///\/ AUD/USD:HP:S .043 1.35 29/34 1.0 \/\\/./\\\/ AUD/USD:LP .029 1.66 75/149 7.5 \/X///X\/X/ AUD/USD:LP:L .029 1.80 42/71 6.8 \//////\/\/ AUD/USD:LP:S .058 1.23 33/78 0.6 \/\///\\/// EUR/USD:CT .009 1.11 22/33 0.5 X/\X\X\X/XX EUR/USD:CT:L .027 1.22 10/19 0.7 \/\/\\\\.// EUR/USD:CT:S .000 0.91 12/14 -0.2 /.\\\/\//\\ EUR/USD:HP .036 1.32 45/59 2.4 \///\/\\\/\ EUR/USD:HP:L .036 1.32 45/59 2.4 \///\/\\\/\ EUR/USD:HP:S .000 ---- 0/0 0.0 ........... EUR/USD:VO .027 2.20 24/23 3.3 .X.//.\X/XX EUR/USD:VO:L .027 1.58 12/11 0.9 ././...//\\ EUR/USD:VO:S .032 2.90 12/12 2.5 .\../.\\.// GER30:BB .038 1.03 2/4 0.0 /......\\/\ GER30:BB:L .038 1.03 2/4 0.0 /......\\/\ GER30:BB:S .000 ---- 0/0 0.0 ........... GER30:CT .256 1.92 3/2 0.6 \/./...\/.. GER30:CT:L .256 1.92 3/2 0.6 \/./...\/.. GER30:CT:S .000 ---- 0/0 0.0 ........... GER30:ES .267 1.82 2/3 0.2 ..\/\../..\ GER30:ES:L .000 ---- 0/0 0.0 ........... GER30:ES:S .267 1.82 2/3 0.2 ..\/\../..\ GER30:VO .051 1.31 27/36 1.7 ////\.\\/\/ GER30:VO:L .051 1.31 27/36 1.7 ////\.\\/\/ GER30:VO:S .000 ---- 0/0 0.0 ........... SPX500:ES .110 1.44 17/21 1.3 //\/\///\\\ SPX500:ES:L .110 1.44 17/21 1.3 //\/\///\\\ SPX500:ES:S .000 ---- 0/0 0.0 ........... SPX500:LP .006 1.04 17/55 0.2 \\/\\\\\//\ SPX500:LP:L .006 1.04 17/55 0.2 \\/\\\\\//\ SPX500:LP:S .000 ---- 0/0 0.0 ........... USD/JPY:BB .057 1.51 24/36 0.6 \/\\/\/.\./ USD/JPY:BB:L .000 ---- 0/0 0.0 ........... USD/JPY:BB:S .057 1.51 24/36 0.6 \/\\/\/.\./ USD/JPY:CT .016 1.46 16/19 2.0 \./..\/.\// USD/JPY:CT:L .016 1.46 16/19 2.0 \./..\/.\// USD/JPY:CT:S .000 ---- 0/0 0.0 ........... USD/JPY:HP .024 2.24 34/29 6.4 .XX/\/\/.\/ USD/JPY:HP:L .024 1.22 9/13 0.3 .\//\/\..\/ USD/JPY:HP:S .028 2.65 25/16 6.0 ./\/.../.\/ XAG/USD:CT .038 1.87 13/13 0.6 ....\///\\/ XAG/USD:CT:L .000 ---- 0/0 0.0 ........... XAG/USD:CT:S .038 1.87 13/13 0.6 ....\///\\/ XAG/USD:HP .018 1.43 44/46 1.1 \\/X/\//X// XAG/USD:HP:L .105 4.16 6/3 0.3 .\./....\/. XAG/USD:HP:S .014 1.33 38/43 0.8 \\/\/\///// XAG/USD:VO .011 1.39 40/62 3.0 .\/\//\\\// XAG/USD:VO:L .000 ---- 0/0 0.0 ........... XAG/USD:VO:S .011 1.39 40/62 3.0 .\/\//\\\//

The following table shows the meaning of the values. Most of the calculated values are only valid for a profitable report (Gross Win > Gross Loss); they are meaningless when the profit is negative. Indicated values with a "$" suffix are in units of the account currency (not necessarily US-$), indicated values with a "p" or "pips" suffix are in pips.

| Bar period | Bar period in seconds, minutes, or hours, and average bar duration in minutes. The average bar duration is the date difference of the last and first bar, divided by number of bars. It is used in subsequent figures for converting bar numbers to time periods - hours, days, or weeks - and might not reflect the real period. Variations in bar duration are caused by weekends, holidays, skipped bars, special bars, or gaps in the historical data. |

| Simulation period | Time of the WFO run (usually 4..5 years) and the number of bars, without the preceding lookback period. |

| Test period | Time and bar number of the test; simulation period without training and lookback. |

| WFO test cycles | Number and length of the WFO test cycles in bars, hours, trading days, or calendar weeks. This is also the recommended period for re-training a WFO system. The given time periods are based on the average bar duration displayed above, and a 5-day week. |

| WFO train cycles | Number and length of the WFO training cycles. |

| Lookback period | Amount of data to be collected before test or training begins. |

| Monte Carlo cycles / Confidence |

Number of Monte Carlo simulation cycles, and selected confidence level (if any) for the following performance figures. |

| Fill mode | Simulated fill mode (Naive or Realistic) and Slippage. |

| Avg bar | Average number of price ticks and average high-low difference per bar in the simulation; for single asset strategies. |

| Spread | Spread in pips, and long/short rollover fee in account currency units; for single asset strategies. |

| Commission | Roundturn commission in account currency units; for single asset strategies. |

| Lot size | Lot size in contracts or underlying units; for single asset strategies. |

| Gross win / loss | Sums of all wins and all losses in account currency units, the overall volume-neutral result in pips, and the result by linear regression of the equity curve (ReturnLR). A negative pip result and a positive gross win - or vice versa - is possible due to different assets pip costs and different trade volumes. |

| Virtual win / loss | Sums of all wins and all losses of phantom trades in currency units, for virtual hedging. Normally worse than the gross win / loss due to higher transaction costs. |

| Average profit | Annual, monthly, and daily profit (workdays only); simply the difference between start and end balance divided by the number of periods. |

| Max drawdown / MAE | Maximum drawdown during the test period, in account currency units and in percent from the gross profit. The drawdown is the difference between a balance peak and the lowest subsequent equity valley (balance = account value, equity = balance plus value of the all open trades). MAE (maximum adverse excursion) is the difference between an equity peak and the lowest subsequent equity valley. Drawdown is dangerous, MAE is not (see remarks below). |

| Total down time / TAE | Percentage of time when the current equity is below a preceding balance peak. TAE (time in adverse excursion) is the time when trades are open and the current equity is below a preceding equity peak. Strategies often have up to 90% down time, but can be still profitable. |

| Max down time | Longest drawdown duration, i.e. maximum time from a balance peak to the lowest subsequent equity valley. The BALANCE flag can be used for generating a balance chart and identifying the balance peaks in the profit curve. |

| Max open margin | Maximum total margin allocated during the backtest period. |

| Max open risk | Maximum loss when all open trades hit their initial Stop at the worst possible moment. Dependent on the stop distances and the likeliness of such an event, the Max open risk can far exceed the Capital required. This parameter has no meaning for virtual hedging strategies or for strategies that use no stop loss for some trades. |

| Trade volume | Total and annualized value of all assets bought and sold, in units of the account currency (see remarks). |

| Transaction costs | Total costs of spread (Spr), slippage (Slp), swap/rollover/margin interest (Rol) and commission (Com) for all trades. Slippage and rollover can increase the profit in some cases; costs are then positive. In test mode the simulated costs are displayed, in trade mode the real costs when available through the broker API. Otherwise the cost are estimated and can be inaccurate. Slippage cost in trade mode is calculated from the difference of price at order time and fill price. |

| Capital required | Required initial capital for trading the strategy; equivalent to the maximum margin on non-leveraged accounts, and the sum of maximum margin and normalized maximum drawdown or MAE on leveraged accounts. This amount would be required when the strategy is entered at the worst possible moment of the simulation, for instance directly at a balance peak preceding a drawdown. For strategies that reinvest profits (Capital variable), the displayed value is multiplied with the ratio of initial and final balance, and thus can be much smaller than the maximum drawdown or open margin. |

| Number of trades | Number of trades in the backtest period. Only real trades are counted, not phantom or pending trades. |

| Percent winning | Percentage of winning trades. |

| Max win / loss | Maximum win and loss of all trades. |

| Avg trade profit | Average return of a trade in account currency units and in volume-neutral pips; separately listed for winning (+) and losing (-) trades. Robust strategies should return a multiple of the spread. Avoid systems that generate either many trades with small average returns, or few trades with very large average returns. |

| Avg trade slippage | Average slippage cost of a trade in account currency units and in pips; separately listed for positive (+) and negative (-) slippage. In test mode it's the simulated slippage, in trade mode the real slippage. |

| Avg trade bars | Average number of bars of a trade; separately for winning (+) and losing (-) trades. |

| Max trade bars | Maximum time a trade was open. |

| Time in market | Total time of all trades compared to the backtest time. This can be more than 100% when several trades are open at the same time. The smaller the time in market, the less exposed is the capital to the market risk. |

| Max open trades | Maximum number of simultaneously open trades. |

| Max loss streak / uncorrelated |

Maximum number of consecutive losses during the test, and the theoretical number under the assumption of uncorrelated returns, i.e. equally distributed wins and losses. If the real number is noticeably higher, wins and losses tend to cluster with this strategy, and an equity curve trading algorithm could improve the performance. |

| Annual return (AR) | Annualized profit divided by the required initial capital; main performance parameter for systems that don't reinvest profits. Equivalent to the Calmar Ratio. Depends on maximum drawdown and can thus be subject to random fluctuations (see remarks). |

| Return on margin (ROI) |

Annualized profit divided by maximum required margin. For accounts with no leverage, where the investment is mainly used for margin, not for buffering drawdowns, |

| Annual growth rate (CAGR) |

Compound annual growth rate of the investment; the nth root of the total equity growth, where n is the number of years in the test period. Displayed for strategies that have the Capital variable set and are assumed to reinvest profits. The annual return on capital (ROI) is also displayed. |

| Profit factor / PRR | Gross win divided by gross loss. The pessimistic return ratio (PRR) is the profit factor multiplied by (1-1/sqrt(W))/(1+1/sqrt(L)); it gives a worse result when the number of trades is low. |

| Reward/Risk ratio |

End profit divided by maximum drawdown. |

| Sharpe / Sortino ratio |

The Sharpe ratio is the annualized ratio of mean and standard deviation of the bar returns when the system is in the market; the Sortino ratio is the annualized ratio of mean and semi-deviation. Bar returns are bar profits divided by invested or required capital. Bars with no open trades do not contribute. The Sharpe ratio is a popular performance gauge (see remarks) and should be > 1 for good strategies. |

| Kelly criterion | Ratio of mean and variance of the bar returns when the system is in the market; bars with no trades do not contribute. The kelly criterion is the optimal investment factor for a single-asset, single-algo, single-trade per bar strategy to maximize the profit. |

| R2 coefficient | Coefficient of determination; the similarity of the equity curve with a straight line ending up at the same profit. The closer R2 is to 1, the steadier are the profits and the better they will be possibly reproduced in real trading (see remarks). |

| Ulcer index | Mean drawdown percentage; a measure of length and depth of drawdowns (see remarks). The higher the ulcer index, the stronger your stomach must be for trading the script. The ulcer index should be < 10% for preventing ulcer. |

| Scholz tax | 26.375% of the gross win, minus EUR 10,000 for any trading year. Only displayed when tax is due and ScholzBrake is not set. |

| Cycle performance | Separate profit factors of the oversampling cycles. High profit differences between cycles are a sign of an unstable strategy. |

| Year | Annual and monthly returns, either in percent of the Capital required for non-reinvesting strategies, or as percent change from the preceding month or year for reinvesting strategies with nonzero Capital variable. |

| Monte Carlo analysis |

Performance analysis (see Monte Carlo Method; non-reinvesting strategies only) by evaluating many possible equity curves with different distributions of trades and returns. A strong serial correlation of trade returns can cause Monte Carlo results higher than the result from the real equity curve. |

| Confidence level | Confidence level of the following performance parameters. F.i. at 95% confidence level, 95% of all simulations generated the same or better results, and 5% generated worse results. |

| AR | Annual return at the given confidence level. |

| DDMax | Maximum drawdown (not normalized) at the given confidence level. |

| Capital | Capital requirement at the given confidence level. |

| Portfolio analysis |

Performance analysis per asset, per algorithm, and per component. Only components with trades are listed. The figures are taken from the last oversampling cycle; when the ALLCYCLES flag is set, they are taken from all cycles. |

| OptF | OptimalF factors for portfolio components (see Money Management; non-reinvesting strategies only). When 0, the component was unprofitable in the test. Calculating OptimalF factors can take a long time when many trades were opened. When the NOFACTORS flag is set or Capital is nonzero with a reinvesting strategy, no factors are calculated. |

| ProF | Profit factor (gross win divided by gross loss, including phantom trades). A '++++' in the column indicates that there were only winners, '----' indicates that there were no winners. |

| Win / Loss | Number of winning and losing trades, including phantom trades. |

| Wgt% | Weight of the component in percent; component profit divided by total profit. Indicates the contribution of the component to the whole strategy. The weight can be negative, f.i. with a losing component and a positive overall result. |

| Result | Current profit or loss of the component in live trading. |

| Cycles | Profit separated by WFO cycles. '/' is a winning cycle, '\' a losing cycle, 'X' is a cycle with both winning and losing components, and '.' is a cycle without trades. |

Additionally, the performance can be evaluated by user criteria or stored for further evaluation with the user-supplied evaluate function.

Keep in mind that that all those performance figures are derived from historical data (even when it's out-of-sample data). The future is unknown, so there is no guarantee to achieve the same performance in live trading. Many figures - f.i. Sharpe ratio, Monte Carlo analysis, drawdown extrapolation, R2 coefficient - are based on mathematical models that assume a Gaussian distribution of returns. However there is no guarantee that real returns always follow a Gaussian distribution. For those reasons, don't interpret too much into performance figures. Even a system with excellent theoretical performance can cause real loss of money.

* See Malik Magdon-Ismail / Amir Atiya, "Maximum Drawdown", 2004.